Per diem work offers a flexible alternative to traditional employment, allowing workers to earn income on an as-needed basis. Whether you’re a business owner looking to manage staffing needs or a professional seeking more control over your schedule, understanding per diem work can open up new opportunities. In this article, we’ll explore what is per diem work, how it differs from other employment types, and the pros and cons for both employers and employees. To make the most of this arrangement, utilizing the best time tracking software can help ensure accurate billing and efficient time management.

What Is the Meaning of Per Diem Job?

What does per diem mean for jobs? Per diem work refers to a type of employment where individuals are hired on a day-to-day basis, as needed by the employer. The term “per diem” is Latin for “per day,” highlighting the temporary and flexible nature of this work arrangement.

Unlike full-time or part-time positions, per diem workers don’t have a fixed schedule or guaranteed hours. Instead, they are called in to work during busy periods, to cover for absent employees, or when there’s an immediate need for extra staff.

Per diem shift are common in industries like healthcare, education, construction, and hospitality, where demand for workers can fluctuate significantly. Employees are typically paid a daily rate, which may be higher than the hourly rate of regular employees, reflecting the lack of job security and benefits such as health insurance, paid time off, or retirement plans.

What Is Per Diem for Travel Expenses?

Per diem for travel expenses refers to the daily allowance provided to employees to cover costs incurred while traveling for work. This allowance typically covers meals, lodging, and incidental expenses such as tips, laundry, and other minor costs associated with business travel. Instead of reimbursing employees for each individual expense, companies offer a fixed per diem amount, simplifying the expense reporting process.

The working per diem rate is often set according to federal guidelines, like those provided by the General Services Administration (GSA) in the U.S., which vary based on the travel destination’s cost of living. This approach not only streamlines accounting but also ensures compliance with tax regulations, as employees do not have to provide detailed receipts, making the reimbursement process quicker and more efficient.

How Per Diem Works

For Work

Payment structure

Per diem employees are paid a fixed daily rate for each day they work, rather than an hourly wage or salary. This structure provides flexibility but generally lacks the benefits offered to full-time employees, such as health insurance or paid leave.

Scheduling and hours

Per diem workers typically enjoy flexible schedules, with the ability to choose when they work. They are often called in during peak times, to cover shifts, or for specific projects. However, this flexibility comes with the trade-off of inconsistent work availability and income.

For travel expenses

Receiving per diem

Employees traveling for work may receive a per diem allowance to cover daily expenses like meals and lodging. This allowance can be provided either as an advance or reimbursed after the trip, depending on the company’s policy.

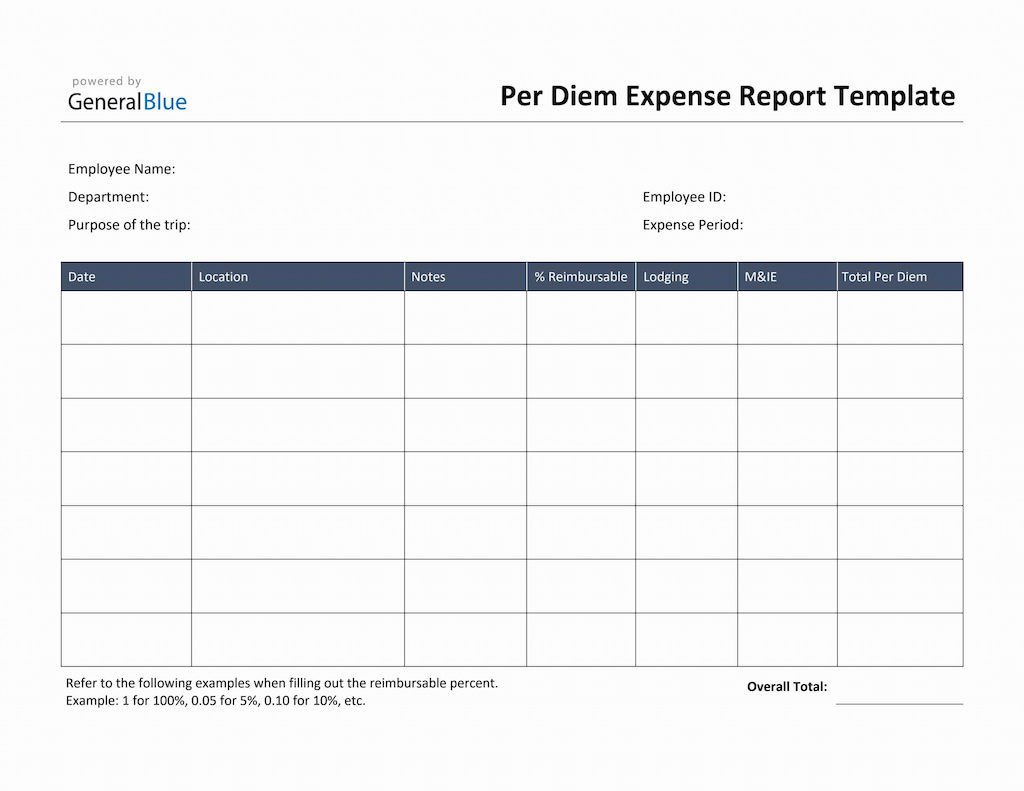

Expense reporting

Per diem simplifies expense management by eliminating the need for detailed receipts for covered expenses like meals and lodging. However, if expenses exceed the per diem or if additional costs are incurred, employees might need to report those with receipts according to company guidelines.

Tax Implications of Per Diem

Understanding if per diem taxable is crucial for both employers and employees. Here’s how it breaks down:

For employers

- Deductibility: Most per diem payments made to employees for business travel are tax-deductible, as long as they adhere to IRS guidelines. However, if the per diem exceeds the federal rates set by the IRS or General Services Administration (GSA), the excess amount may not be deductible.

- Accountable plan: To ensure that per diem payments are not taxable, employers must have an “accountable plan” in place. This means the expenses must be work-related, employees must provide a detailed expense report, and any excess per diem must be returned to the employer.

For employees

- Non-taxable income: When per diem payments fall within the IRS-approved rates and are made under an accountable plan, they are not considered taxable income. Employees receive these funds as a reimbursement for travel expenses rather than as part of their wages.

- Taxable situations: If per diem payments exceed the federal rates or if the company does not have an accountable plan, the excess amount may be treated as taxable income. This means it would be subject to income tax and reported on the employee’s W-2 form.

- Reporting requirements: Employees must submit an expense report within a reasonable timeframe, typically 60 days, detailing the trip’s purpose, location, and duration. Failing to do so could result in the entire per diem being considered taxable income.

Pros and Cons of Per Diem

When considering per diem work or payments, it’s essential to weigh the advantages and disadvantages to determine if it’s the right fit for your business or personal situation.

✅ Pros of per diem

For employees

- Flexibility: Per diem work offers a high degree of flexibility, allowing workers to choose assignments based on their availability, which can be ideal for those balancing other commitments.

- Potential for higher pay: Since per diem workers are often hired for short-term needs, they may receive a higher daily rate compared to full-time employees to compensate for the lack of benefits.

- Diverse work experiences: Per diem roles often allow workers to gain experience in various environments and industries, broadening their skills and professional network.

For employers

- Cost savings: Employers can save on costs such as benefits and long-term commitments, as per diem workers typically do not receive healthcare, retirement plans, or paid time off.

- Scalability: Businesses can quickly scale their workforce up or down in response to fluctuating demand without the administrative burden of hiring full-time staff.

❌ Cons of per diem

For employees

- Lack of benefits: Per diem workers often do not receive health insurance, retirement benefits, paid time off, or job security, which can be a significant drawback compared to full-time positions.

- Inconsistent work: The availability of per diem work can be unpredictable, leading to income instability and uncertainty about future employment opportunities.

- Limited career growth: Frequent changes in work assignments may limit opportunities for long-term career growth and advancement within a single organization.

For employers

- Potential for higher turnover: Per diem workers may be less committed to the company, leading to higher turnover rates and the need for constant recruitment and training.

- Less control over schedules: Employers may face challenges in scheduling, as per diem workers prioritize their availability and may not always be available when needed.

- Variable quality of work: The temporary nature of per diem work might result in varying levels of dedication and quality, as workers may not have the same investment in the company’s long-term success.

Per Diem Rates and Policies

Understanding how per diem rates are determined and what policies govern their use is crucial for both employees and employers. These rates can vary widely depending on the industry, location, and specific job requirements.

Work per diem rates

🏭 Industry and role variations: Per diem rates for work can differ significantly depending on the industry and the role. For example, healthcare professionals, such as nurses, might receive higher per diem rates compared to administrative staff due to the specialized skills required. Similarly, roles that demand more travel or operate in high-demand industries might offer more competitive per diem rates.

🗺️ Regional differences: The location where the work is performed also plays a role in determining per diem rates. Urban areas or regions with a higher cost of living typically offer higher per diem rates to compensate for the increased expenses.

Travel per diem rates

⚖️ Federal per diem rates: For travel, per diem rates are often guided by federal standards, especially for businesses operating within the United States. These rates are set by the General Services Administration (GSA) and vary by city and time of year. For example, in a high-cost city like New York, the per diem rate for lodging can be significantly higher than in a rural area.

Examples of U.S. cities:

- New York, NY: $297 per day for lodging and $74 for meals and incidental expenses.

- Los Angeles, CA: $182 per day for lodging and $64 for meals and incidental expenses.

- Chicago, IL: $194 per day for lodging and $71 for meals and incidental expenses.

🌐 International locations: For international travel, the U.S. Department of State provides per diem rates, which also vary by country and city. For instance, London might have a higher per diem rate than other cities in the UK due to its higher living costs.

Company policies

While federal rates provide a guideline, each company may have its own policies regarding per diem. Some companies might offer a flat per diem rate regardless of location, while others might adhere strictly to GSA rates. It’s crucial for employees to understand their company’s specific per diem policies, including how rates are determined, how payments are issued, and what documentation is required.

Policy inclusions

- Advance vs. reimbursement: Clarify whether the per diem is provided in advance or as a reimbursement after the trip.

- Documentation requirements: Some employers might require receipts even if the per diem falls within the standard rate, while others may not.

- Exceeding rates: If an employee’s expenses exceed the per diem rate, they need to understand whether the company will cover the difference or if it will come out of pocket.

How to Manage Per Diem

Effectively managing per diem can help maximize its benefits and ensure proper use. Whether for work opportunities or travel expenses, having a strategic approach can make a significant difference.

For work

🔍 Finding per diem opportunities

- Networking and industry resources: Leverage industry connections and job boards that specialize in per diem positions. Many fields, such as healthcare and education, offer job listings specifically for per diem roles.

- Agency registrations: Consider registering with staffing agencies that provide per diem workers to various employers. These agencies can match your skills with opportunities requiring per diem staffing.

- Freelance platforms: Explore freelance and gig economy platforms where per diem work might be listed. These platforms can offer flexibility and a variety of short-term job opportunities.

💪 Managing a per diem career

- Flexibility: Embrace the variability of per diem work. Be prepared for fluctuating hours and locations, and adapt to changing job demands.

- Multiple opportunities: If feasible, take on per diem roles with different employers to increase your income and gain diverse experiences. Just be mindful of managing multiple schedules effectively.

- Skill development: Continuously improve your skills and qualifications to enhance your attractiveness for per diem roles and potentially command higher rates.

For Travel Expenses

🔝 Maximizing per diem

- Plan ahead: Research the per diem rates for your destination before booking travel. This can help you plan your expenses to stay within the allotted amount and avoid unnecessary out-of-pocket costs.

- Budget wisely: Allocate your per diem budget wisely. For instance, if you receive a daily meal allowance, prioritize cost-effective dining options to stretch your allowance further.

- Utilize discounts: Take advantage of discounts and special offers for accommodations and meals. This can help you stay within per diem limits and possibly save money.

📚 Record keeping

- Maintain records: Even if your employer does not require receipts for per diem, it’s good practice to keep detailed records of your expenses. This can be useful for personal tracking and in case of any discrepancies.

- Use apps and tools: Consider using expense tracking software to manage your per diem funds. These tools can help you categorize expenses and keep a log of your spending, ensuring you remain within budget.

- Regular reviews: Periodically review your spending patterns to ensure you are consistently managing within the per diem limits. Adjust your budgeting strategies if you notice recurring issues or overspending.

By applying these strategies, you can effectively manage per diem for both work and travel, ensuring you make the most out of the allowances provided and maintain financial discipline.

FAQ: Per Diem Employment

❓ What is the difference between per diem and a salary?

Per diem is a daily allowance given to employees to cover expenses incurred while traveling or working on a temporary basis. It is typically not guaranteed and can vary based on the job or travel location. Salary, on the other hand, is a fixed amount of money paid regularly (e.g., monthly) to employees regardless of the number of days worked.

❓ How does per diem pay differ from hourly or salaried work?

Per diem pay is typically a daily rate agreed upon by the employer and employee, and it only covers the specific days worked. Unlike hourly workers, who are paid based on the exact number of hours worked, or salaried employees, who receive a consistent paycheck, per diem workers do not receive payment for days they do not work.

❓ Are per diem employees entitled to benefits?

Generally, per diem employees are not entitled to the same benefits as full-time employees, such as health insurance, paid time off, or retirement plans. However, this can vary by employer and jurisdiction, so it’s important to check with your employer about the specific terms of per diem employment.

❓ What types of jobs commonly offer per diem work?

Per diem work is common in industries that require flexible staffing, such as healthcare, education, and hospitality. Nurses, substitute teachers, and temporary event staff are examples of roles where per diem employment is often used.

❓ Are per diem payments taxable?

Per diem payments are generally not taxable if they meet certain IRS guidelines. As long as the payments fall within the federal per diem rates and are provided under an accountable plan, they are not considered taxable income. However, any amount exceeding the federal rates may be taxable.

❓ How do I calculate the correct per diem rate for my travel?

To calculate per diem rates, refer to the General Services Administration (GSA) rates for domestic travel or the U.S. Department of State for international locations. The per diem rate typically includes allowances for lodging, meals, and incidental expenses. You can use these rates to budget your expenses or reimburse your employees accurately.

❓ Can per diem be used for non-business-related expenses?

No, per diem is intended solely for business-related expenses. It covers costs like meals, lodging, and incidentals incurred while traveling for work. Personal expenses or activities not related to the business should be paid out-of-pocket by the employee.

❓ What should I do if my actual expenses exceed the per diem amount?

If your actual expenses exceed the per diem amount provided, you will need to cover the additional costs yourself. However, if your employer’s policy allows, you might be able to submit the excess amount for reimbursement, provided you have supporting documentation and it is in line with the company’s expense policy.

❓ How can I keep track of per diem expenses?

To keep track of per diem expenses, consider using expense tracking apps or tools. Even if receipts are not required, maintaining a log of your expenditures can help you stay within budget and provide a record for any future discrepancies. Keeping a detailed account of your spending ensures you are managing your allowance effectively.

❓ How often are per diem rates updated?

Per diem rates are updated annually by the General Services Administration (GSA) for domestic travel and by the U.S. Department of State for international locations. These updates reflect changes in living costs and can vary by region or city. It’s important to check for the latest rates before planning or reimbursing travel expenses.

Conclusion

Per diem can simplify expense management for both employers and employees, providing a clear and flexible way to handle daily costs. Understanding the rates, tax implications, and management strategies is key to making the most of this system.

For a streamlined approach to tracking per diem and managing expenses, Everhour offers powerful tools to enhance your financial management. Explore how Everhour can make your per diem tracking effortless and efficient today.

If you are managing a team of 5 or more and looking to boost efficiency, Everhour is the perfect tool to keep your team on track. With seamless time tracking, you can easily estimate task durations, set clear budgets, and generate detailed reports inside Asana, Trello, Jira, or any other pm tool.