Knowing how to write an invoice is an important skill for any freelancer, lawyer, startup, or small business. And if you aren’t an established business and just starting, it is worth time to learn how to do it more effectively. Also, worth noting that the process is made significantly more efficient with the aid of the best time tracking and invoicing software 🙂

In this article, you’ll discover:

- How to write an invoice effectively (including a FREE invoice generator)

- What details the invoice absolutely must include

- The best way to schedule your invoices

- Why personalization matters (including FREE invoice letter templates)

- How to handle ‘bad debts’

Step-by-Step Guide: Writing a Clear and Professional Invoice

Before you even get started creating your invoice system and learning how to write an invoice, you’ve got to figure out which method to choose – a blank template, specialized invoice software, or an online invoice generator. Below are the pros and cons of these types.

| 1️⃣TEMPLATES (PDF, DOC, EXCEL) | 2️⃣SPECIALIZED SOFTWARE | 3️⃣FREE ONLINE GENERATORS | |

|---|---|---|---|

| Time | ✅(depends on template) | ✅(after signup and account setup) | ✅(easy) |

| Automation | ❌(not possible) | ✅(pretty much everything) | ❌(very basic) |

| Flexibility | ✅(all on you) | ❌(to some extent) | ❌(very basic) |

| Simplicity | ✅(easy) | ❌(might require training) | ✅(easy) |

| Analytics | ❌(very hard) | ✅(possible in most cases) | ❌(mostly not possible) |

| Accessibility | ❌(desktop) | ✅(any computer or mobile) | ✅(any computer or mobile) |

| Fees | ✅(free) | ✅(low, approx. $15-30 / mo) | ✅(free) |

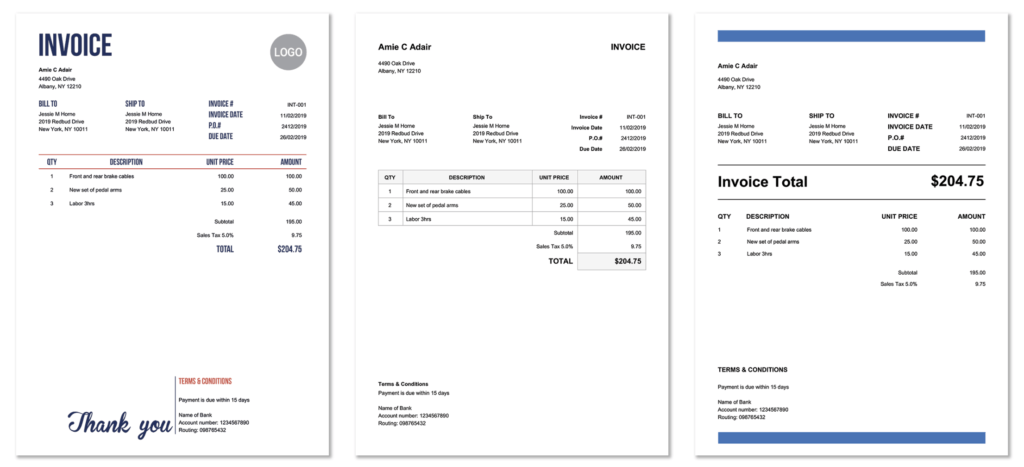

Standard paper and software templates

Standard paper blanks and basic software are the old-fashioned way to invoice. Time-proven, this system is still in use. Below we’ve listed some pros and cons of using paper blanks and software when invoicing.

Why old-school isn’t always bad

- Simplicity – It’s an easy-to-use method that can be applied by anyone who knows the basics of invoicing. All you need is a pen and paper, or just basic computer skills.

- (Almost) Free of charge – Paper blanks do not require a yearly subscription, programs such as Microsoft Office may. But, the primary function of this type is to make invoicing affordable and doable for everyone.

- Many templates – You can easily find a huge number of different templates for your liking. So there’s no need to invent everything from scratch.

- Automatic calculation in most cases – Almost every template includes some basic math, which will save you from simple errors in the calculations.

- Flexibility – You can track all your invoices in one place and with minimal effort adapt the template to any specific needs.

Cons of invoice templates

- Quantity – If your business is rather large and you cooperate with more than five companies, writing invoices manually could turn into a logistical problem. Making keeping track of the status of payments, a nightmare.

- High error risk – Inattention or a software glitch may result in an error that is hard to spot and fix.

- Accounting problems – Free templates require no special skills when invoicing but it can make accounting tricky later, especially if you’re not trained.

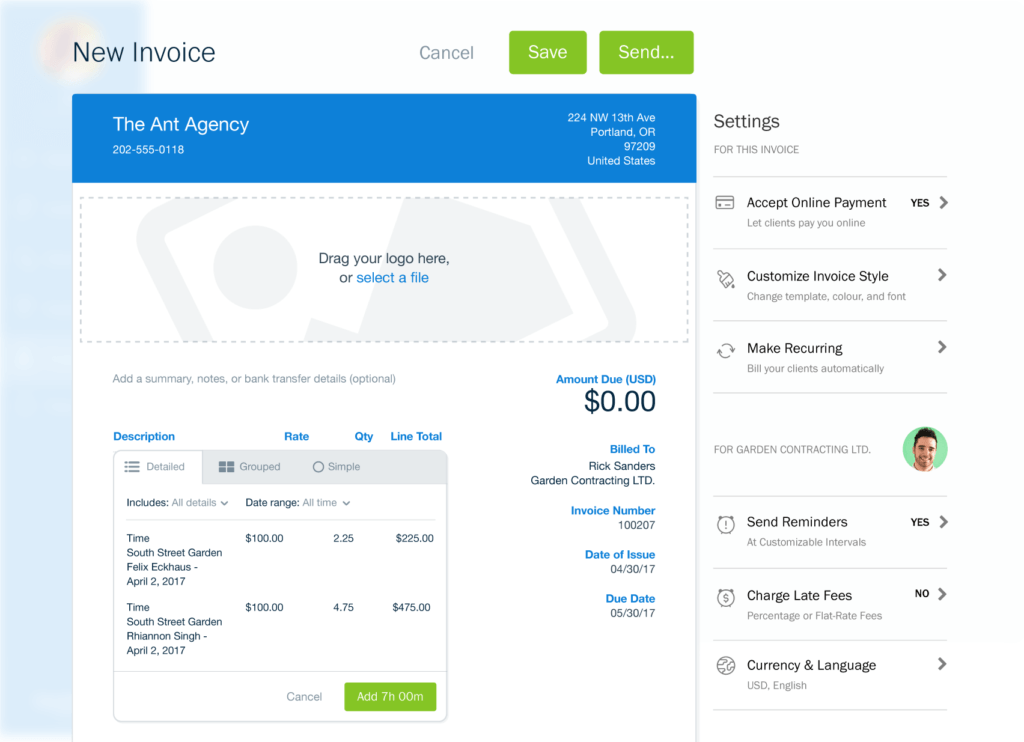

Specialized invoice software

Specialized invoice software is created, especially for freelancers, startups, and small businesses to invoice effectively. It usually comes in the form of software programs installed on your computer, mobile apps, or sites, such as FreshBooks or QuickBooks.

Is it right for my company?

- Accessibility – You can access your account from any location, any time, and using any device, even when offline. It can also be combined with a time tracker, such as Everhour to make billing more efficient.

- Intuitive UI – Intuitive user interface with helpful popups and customer support.

- Easy-to-follow updates – Keep a watch on your invoice statistics, know precisely when your clients pay you.

- Multiple app access – Provides two or more employees with access to the program.

- Online support – There are more ways to communicate with customers than through traditional software, for example, online customer support in live chats.

Some cons of using special invoice software

- Downtime – Unavailability due to occasional maintenance.

- Bugs – Instability of the system, they may crash or be very buggy.

- Spam trap – Invoices may end up in the spam folder after being sent through the common software gateway.

- Poor customer support – Customer support systems can vary, so if the worst happens, you could be left with overdue invoices or late responses to your own clients.

- Fees – Some require payment, and this may rise with the growing needs of your business, e.g., number of users, template styles, error corrections, and more.

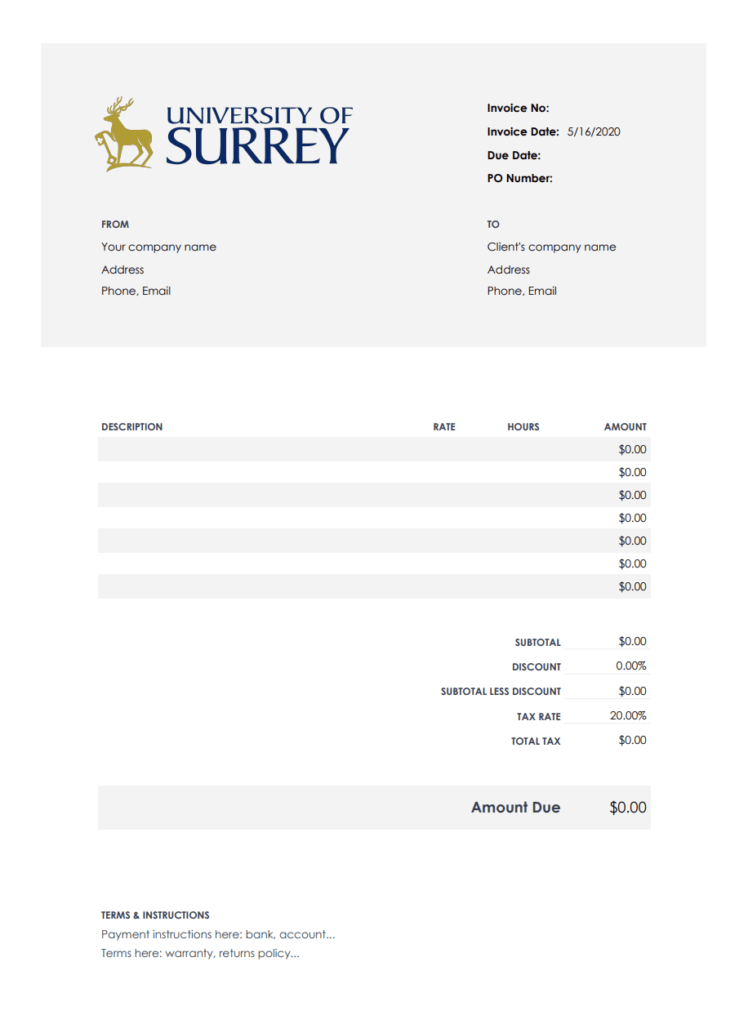

Invoice Template Google Sheets

Don’t worry about building invoices from scratch. Download our free Google Sheets invoice template to create your own invoices to send to your clients. We recommend you use the spreadsheet version because of built-in functions and online access.

Download the Google Sheets Invoice Template

After clicking on one the links, you’ll be taken to the “read-only” version of the invoice template. Select ‘File’ from the top menu, then select ‘Make a copy…’. This way you’ll have your own editable copy that you can modify to your heart’s content.

Include service descriptions, payment terms, and more without having to hire a professional to make it for you or using 3d party software. This free template does all of the heavy lifting for you.

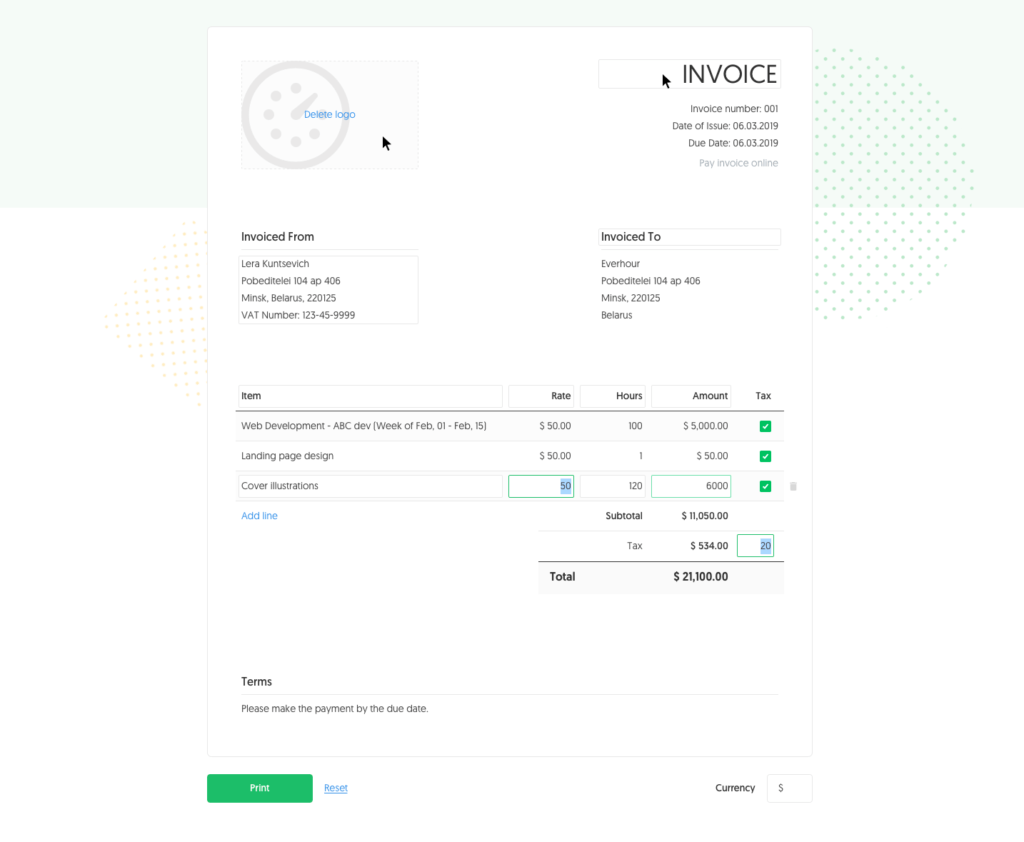

Online invoice generators

Online invoice generators are a type of specialized invoice generator software, growing in popularity due to the possibility of creating an invoice for free on-demand, without the need to create an account or pay monthly fees.

Generally, such systems are limited in functionality but may be suitable for small companies and freelancers.

Everhour free invoice generator lets you create a pro-looking invoice with a link to pay online (via Stripe or PayPal). Customize the layout or even translate the invoice. All settings are saved inside the browser. Works on mobile.

Why online invoice generators could be a good fit for your company?

- Ability to customize the invoice (within reason) – Many online generators allow you to add your logo and company details with ease and include various other factors for flexible invoicing.

- Ability to add payment links – Directly insert links to your payment methods to simplify the process for your clients.

- Accessible online anywhere, anytime – As long as you have an internet connection you can access your invoicing system.

- Anyone in your organization can invoice – No need to add a member to your subscription (generally) anyone in your organization can log in and create the invoices.

When online generators might not be a good idea?

- You need a more complex system – Online generators are set for simplicity; some businesses may require more complex systems. Especially if the tax in your region doesn’t follow a simple process.

- Record-keeping skills needed – You’ll need to keep a separate record of any invoices generated by the online invoicing system if one is not provided.

- Downtime and bugs – Your invoicing system is dependent on the provider, meaning you need to be ready to accept that bugs and downtime may impact your ability to bill.

How to Write Up an Invoice

Now that you know more about the tools available, let’s take a look at how you can start to unpack how to write up your own invoices – what do you need to include in that bill exactly?

- Choose an invoice template – Make it personal but professional. Your invoice represents your business and the image you present to your customers – are you a sober large enterprise, family-friendly mom & pop corporation, or somewhere in between? Whatever your style, it needs to reflect your brand’s image.

- Contact information – In general, this should include your and your client’s contacts – business address, email, and phone number. Remember to add the name of a person who will deal with your invoice. It ensures the right person will get it, and payments can occur quickly and (hopefully) without error.

- Unique invoice number – You’ll need to assign an invoice number to allow you to keep proper records and find that needed invoice quickly in case of any issues. It’s good practice to assign numbers in the “last invoice number +1” order.

- Dates – When you invoice, make sure you assign dates correctly and include when the invoice was created, and the date it should be paid by. This creates clear guidelines of responsibility for both the client and your business.

- Services and costs – Make a detailed list of the services and products provided, including costs, dates, and the amount of time spent on them (if applicable). It’s essential to provide as much detail as possible and with clarity so your customers can understand precisely what they are paying for. Tracking time beforehand helps you to do just this (read more here).

- Payment – Fill out the invoice total, add in discounts or taxes (if applicable) and the method of payment – cheque, online payment via Stripe or PayPal, bank (wire) transfer, etc. If appropriate, it’s best to discuss payment methods in advance so that it’s convenient for both parties.

- Payment terms – It’s important to specify all the terms and due dates in case of delayed payments or unforeseen circumstances. It can be challenging to define how to charge your client with money for a project, especially when it’s not fixed-fee. You’ll need to define billable and non-billable charges, and what counts. Payment terms can also help remind your client about compensation deadlines and any discounts that apply to early payment.

- Comments section – It’s not obligatory, but this is an excellent opportunity to thank your client for working with you as well as promote some further cooperation discounts or add necessary account information.

Depending on where your business and clients are located, you may need to adjust your invoice to consider legal factors. So, we recommend seeking consultation before sending out your first bill.

Best Practices for Scheduling Invoices on Time

Billing isn’t something that should be left to the last minute. That’s why it’s vital for any business to learn how to write and schedule their invoicing accordingly. This is an integral part of business time management, and knowing the how-tos is the key to success.

Top tips for getting your invoice done on time:

- Keep your projects in order.

- Track time and resources spent for non-fixed-fee projects (try Everhour).

- Know who needs to be billed and when.

- Spare time on your invoice writing in advance. (We know this can be time-consuming so allow time for this in your schedule).

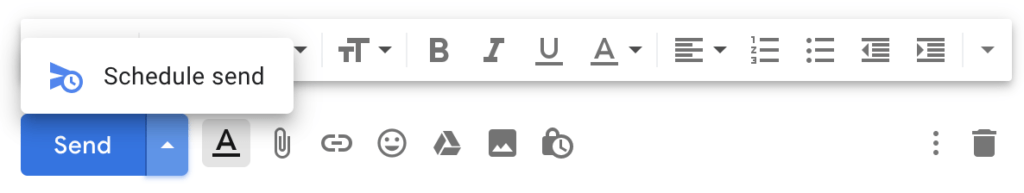

One way to make sure your invoices get to the client on time is by using scheduled emails. Here is how to do it in Gmail.

- Create a new email. Remember to include your invoice as an attachment or link and a friendly message to your client (check out our useful tips below).

- Go to the dropdown arrow next to the “Send” button.

- Choose from the given times and dates to suit your business needs and client’s working hours.

- Click “Schedule send”.

- And you’re done.

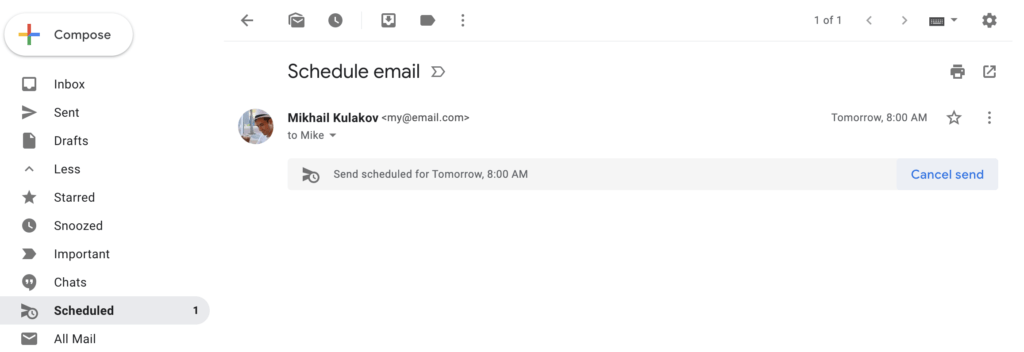

And, if, for some reason, you need to cancel or switch mailing dates, this is what you’ve got to do:

- In your mailbox, click on the “Scheduled” button.

- Pick the email you want to cancel or switch to another date.

- Go to the top of the “Cancel send” button.

- Schedule a new automatic mailing.

Tip. Be sure to get your timesheet and project data calculated on time to allow you ample legroom to get those invoices done on schedule. Consider integrating timekeeping into your project management app to make it a little easier.

How and Why Should You Write a Note to Your Client with Your Invoice?

(FREE invoice templates in Google Docs below)

If you’re just sending a bill to your client, you could be missing out on a unique opportunity to promote your brand’s image and retain customers for the long term.

Depending on where you work and business etiquette, just emailing an invoice could be seen as a little impolite or carefree. That’s why it makes sense to learn how to write some sort of cover letter to your clients to include with your invoice.

Cover letters are usually sent with or before an invoice to notify your client about a future payment in a smooth and polite manner. You can also include some vital information, such as:

- Payment due date

- Numbers of invoice or customer reference

- Partial or full payment details

- A thank you note for doing business with you.

These letters are useful in building customer loyalty and forging a personal connection with your client. According to Bain & Company, a 5% increase in customer retention can boost profits by up to 25%.

To help you get started, we’ve included some helpful and free business letter templates, just for you:

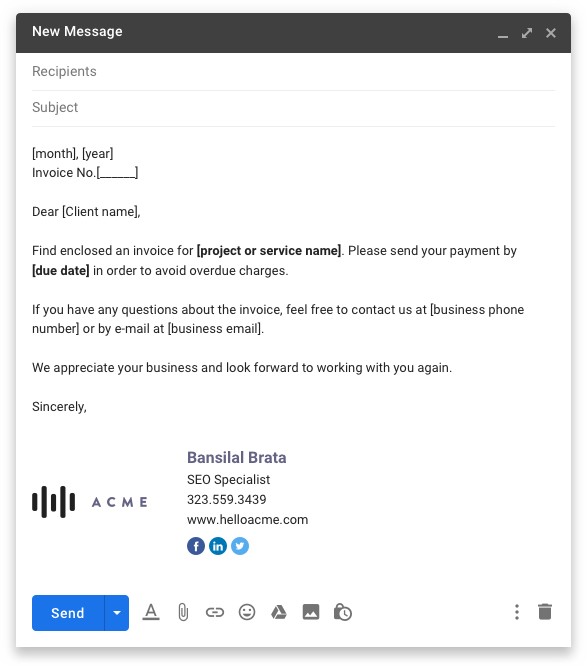

Invoice cover letter template

From: [your business name and address]

[month], [year] Invoice No.[______]

Dear [Client name],

Find enclosed an invoice for [project or service name]. Please send your payment by [due date] in order to avoid overdue charges.

If you have any questions about the invoice, feel free to contact us at [business phone number] or by e-mail at [business email].

We appreciate your business and look forward to working with you again.

Sincerely,

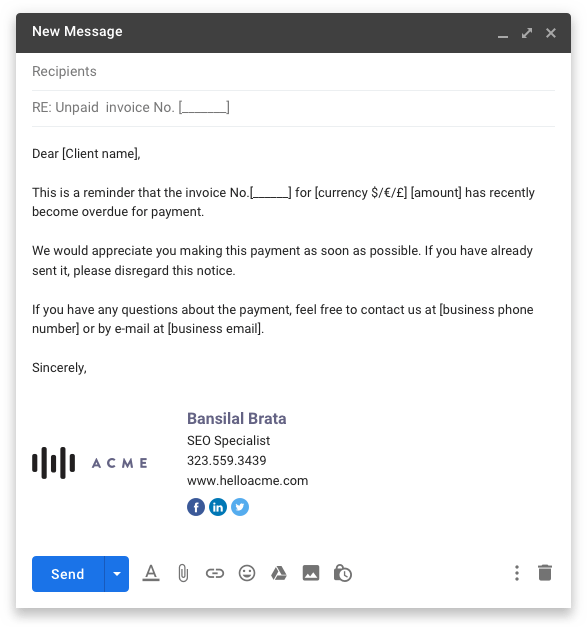

[Your signature]Overdue invoice letter template

From: [your business name and address]

Subject: RE: Unpaid invoice No. [_______]

Dear [Client name],

This is a reminder that the invoice No.[______] for [currency $/€/£] [amount] has recently become overdue for payment.

We would appreciate you making this payment as soon as possible. If you have already sent it, please disregard this notice.

If you have any questions about the payment, feel free to contact us at [business phone number] or by e-mail at [business email].

Sincerely,

[Your signature]To make sure that your client has seen your message and it didn’t end up in spam, install one of the various mailbox extensions, such as HubSpot, MailTrack, or Yesware to track your letters and notify you the minute your client opens your invoice.

Strategies for Managing Bad Debts and Late Payments

Unfortunately, no business is immune to customers that don’t pay on time or at all, and this may turn into uncollectible invoices or “bad debt.” So, how should you deal with these bad debts?

Aside from the handy reminder letter above, you should absolutely send to your client; you’ll need to account for these invoices in your internal accounting system. If you’ve placed an uncollectible invoice sum in your accounting system, in general, there are four main steps to follow:

Keep track of it and create an account for bad debt expense

Create a separate chart for bad debt expenses, here you should store all information on the company’s debts that haven’t been paid, so you can follow up on them later.

Create an item for the bad debt expense account

As you need to show bad debt in your company’s income, you’ve got to identify a “bad debt expense.” Usually, it’s called “a non-inventory item” or “ an extraordinary item” and can have the following information:

- Type: other charges

- Item Name/Number: Bad Debt

- Description: Bad Debt

- Amount: 0,00

- Account: Bad Debt Expense

Create a credit memo for the customer

You need a credit memo to reduce the customer’s unpaid sum. In a credit memo you need to fill out the following info:

- Item: Bad Debt

- QTY (quantity): the quantity you need to write off

- Rate: the amount you need to write off

Apply the credit memo to the customer

Remember these steps above generally apply to the app and online-based systems. Recheck with your accountant to implement them into your accounting system.

Writing off bad debts is usually an unpleasant process. Firstly, you need to know all the specificities on how to do it in an app or your reports. Secondly, it’s quite difficult to deduct these items from your income taxes.

This should give you a general overview of the best way to deal with bad debt. However, if you use accounting software such as QuickBooks, you may need to adapt how to write off an invoice example to suit your accounting style.

Tip. To avoid bad debt issues, it’s a good idea to follow good project management skills and keep in contact with your client throughout the project, not just surprise them with an invoice at the end. You may also consider a pre-payment system to acquire some of the costs in advance.

Invoicing Checklist

Congratulations! You’ve just finished reading our guide on how to invoice! Now, you’re primed to make a start in the world of your business’ accounting. In this article, you have learned how to:

- Pick the right invoicing method for your business

- Compose a stellar billing system that will wow your clients and make your accountant’s life a dream

- Navigate those non-payment issues with ease

- Write a compelling cover letter to build your customer’s trust and loyalty

- Turn invoicing from an end-of-the-month nightmare into a smooth procedure

Remember, any invoicing should be backed by work done, learn more about why tracking project time is important, or implement it today with Everhour!

If you are managing a team of 5 or more and looking to boost efficiency, Everhour is the perfect tool to keep your team on track. With seamless time tracking, you can easily estimate task durations, set clear budgets, and generate detailed reports inside Asana, Trello, Jira, or any other pm tool.

If you find taxes and invoicing too complicated, check out our curated list of the best taxes and accounting memes to have a bit of a laugh!