In the realm of financial calculations and tax considerations, imputed income serves as a significant parameter much like the best time tracking software meticulously accounts for every minute spent. Concepts like calculating imputed earnings and imputed income tax are what keep accountants in demand. It’s a necessity to keep track of imputed pay, and it’s not just the responsibility of payroll and accounting!

Every business owner needs to know its in’s and out’s to be in business for long. In this article, we’ll examine what imputed income means, provide some examples, and show how to report it.

What Is Imputed Income? Key Concepts and Definitions

Its definition is pretty simple. It is “fringe benefits” or “perks” that an employee receives in addition to salaried income.

It can take the form of cash or non-cash compensation. However, as long as it adds to that employees’ taxable income, it’s considered imputed and it should be presented as such on that person’s tax documents.

Common Examples of Imputed Income and Their Tax Impacts

Here are a few examples to illustrate what it is. We’ll compare them to those things which are exempt, or excluded from taxation that you can go ahead and leave off of your W2’s.

Taxable imputed income:

- Personal vehicle usage

- Group-term life insurance over $50,000

- Employee educational assistance over $5,250

- Moving expense reimbursements labeled as non-deductible

- Discounts for goods and services provided by the company exceeding the tax-free limit

- Gym memberships and similar fitness incentives

- Assistance with adoptions exceeding the tax-free amount allotted by the employer

- Assistance for care of dependents exceeding the tax-free amount allotted by the employer

Excluded from taxation:

- Cellphones provided by the employer

- Group-term life insurance up to $50,000

- Employee educational assistance up to $5,250

- Meals during work travel or meetings

- Discounts for goods and services provided by the company up to the tax-free limit

- Health savings accounts, such as a “FLEX” account

- Assistance with adoptions up to the tax-free amount allotted by the employer

- Assistance for care of dependence within the tax-free amount allotted by the employer

It also applies to situations including child support. This type of income is different from the “perks” an individual would ordinarily receive from an employer.

If an individual is voluntarily unemployed, or underemployed, the courts will use factors like past earning history, past employment history, educational level, etc. to calculate imputed income and adjust the payments owed for child support accordingly.

Step-by-Step Guide to Reporting Imputed Income

Reporting your employees’ imputed income is less about when and more about assigning a value to the benefits they receive, but before we get into those details, there are a couple of other noteworthy things to mention:

☝️ Imputed income is reported on the IRS W-2 form, in the appropriate box with a code indicating the type of benefit that was received.

☝️ Only add the value of imputed income to the total taxable income of your employee on their W2. Benefits considered to be exempt, that is, not imputed, should not be recorded with the total taxable income of your employee.

☝️ Imputed income IS NOT subject to federal withholding, so your employees are not paying taxes on that amount out of their weekly paychecks (unless they opt to do so). This doesn’t mean, however, they are exempt, as discussed above, the amount has to be included in the total adjusted gross income at the end of the year.

☝️ Imputed income IS subjected to employment tax withholding though, so employees don’t need to pay additional employment tax at the end of the year because their employer reported imputed income on their W-2 forms that year.

Wondering how often to report imputed income? You can report per pay period, per quarter, semi-annually, or annually, but you should report calendar-year benefits by December 31 of the year in which the benefits were received. Some choose to break it up into shorter time spans to make it easier to track and account for, but it’s really just a matter of preference depending on the amounts of the income you’re receiving.

How to Specify the Value of Imputed Income?

Determining the value of things that fall under the imputed income category can get a little tricky. There are some things that are pretty straightforward because the value is laid out numerically, like educational assistance and group-term life insurance.

Things like personal vehicle usage, moving expense reimbursements, company discounts for goods and services are a little more nuanced. For example, here’s info about the IRS’s rules for how companies can calculate the imputed tax on employee discounts for goods and services.

When in doubt, consult the 15-B: Employer’s Tax Guide to Fringe Benefits. It can help with everything: to determine evaluation rules, exclusion rules, as well as rules for withholding, depositing, and reporting to determine and record your employees’ imputed incomes correctly.

What Is the Easiest Way to Record It?

The easiest way to record imputed income is daily, or at least whenever your employees use the fringe benefits that qualify as it. For instance, if you have an employee driving a company car, recording mileage and gas regularly saves a lot of time and headaches later when it comes time to report.

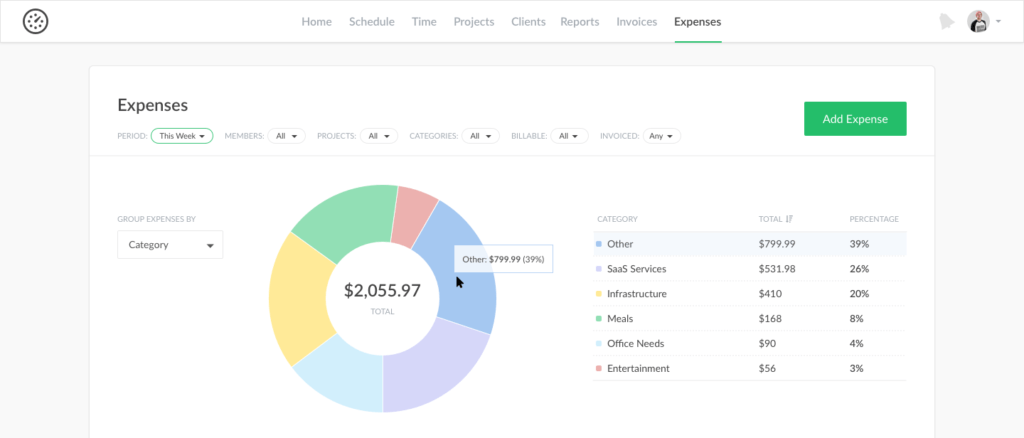

Track expenses that can be considered imputed income with ease

Log expenses effortlessly, share them with your accounting department & optimize your financial processes!

A handy tracking tool can be super helpful for recording imputed income. It helps your company’s accounting because it indicates the use of fringe benefits as congruent with the hours an employee is working.

For instance, if an employee uses a company vehicle during working hours, if you have a comprehensive tracking platform, that logs expenses like gas along with the mileage used, and subsequent depreciation of the vehicle based on the hours that employee tracked.

In Closing

As you can see, imputed income is simple. Though, sometimes assessing the value on a fringe benefit or “perk” isn’t so straightforward. Thankfully, there are plenty of guides and resources from the IRS.Gov for help on how to navigate those ambiguous waters.

Equally as important as understanding the value of your fringe benefits, is understanding how to record them in real-time. The best way to do this is with the kind of diligent time-keeping resources that Everhour offers. It can log expenses with no extra effort, share them with your accounting department (who can check out our article on small business accounting software, by the way ;)), and optimize your financial processes!

Learn how to align payroll, budgets, and client billing without spreadsheets—and simplify your entire workflow today.