Running a small business means wearing 15 hats. But your accounting software shouldn’t feel like one of them. The best accounting software for small businesses isn’t just about tracking expenses. It’s about simplicity, integrations, tax automation, payroll sync, and helping you not hate year-end.

Here’s the no-fluff guide to tools that save you time, money, and sanity.

🔧 TL;DR: Best Small Business Accounting Tools

| 📊 Tool | Best for | Free plan | Payroll support | Specialty focus |

|---|---|---|---|---|

| QuickBooks Online | Most popular & scalable | ❌ | ✅ | Retail, construction, services |

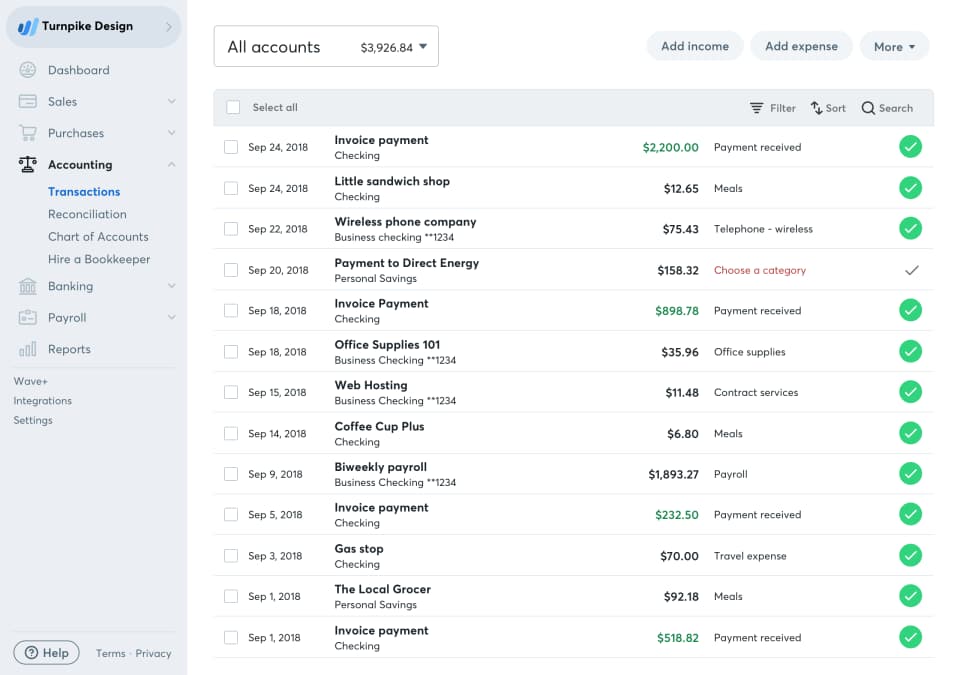

| Wave | Best free software | ✅ | ❌ | Freelancers, solo founders |

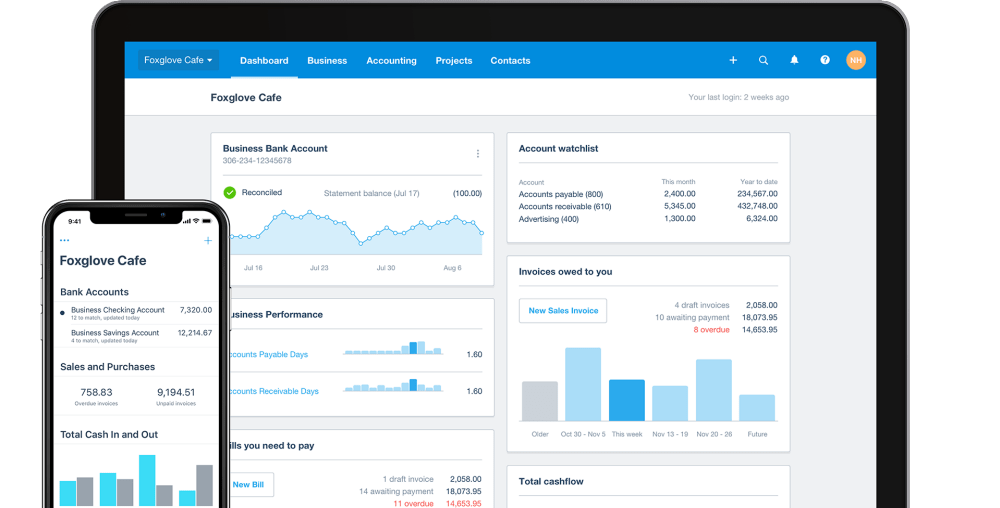

| Xero | Cloud-based accounting | ❌ | ✅ | Small business, global ops |

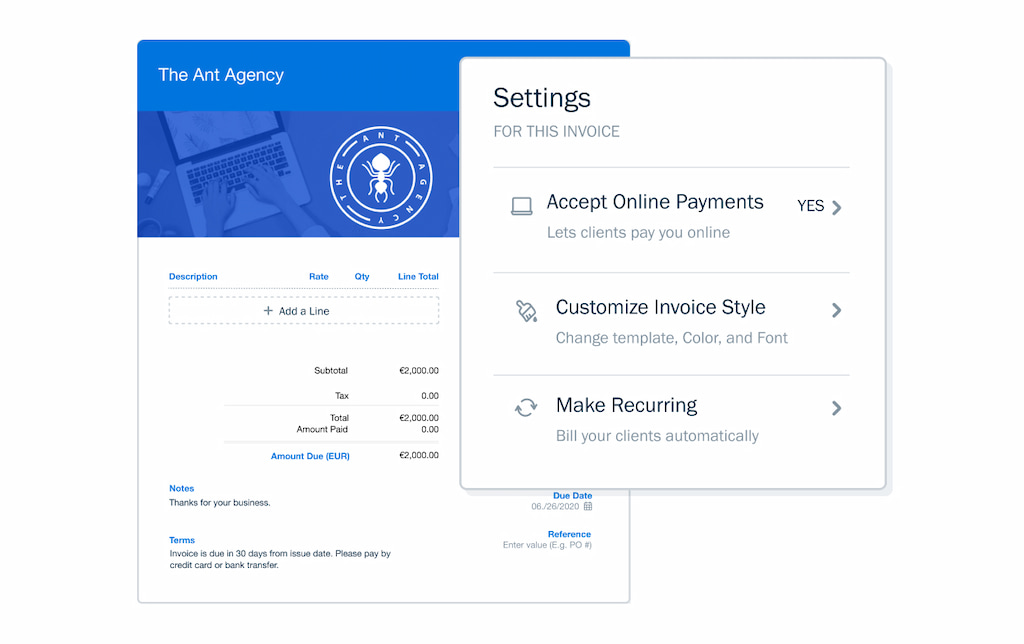

| FreshBooks | Consultants + invoicing | ❌ | ✅ | Professional services |

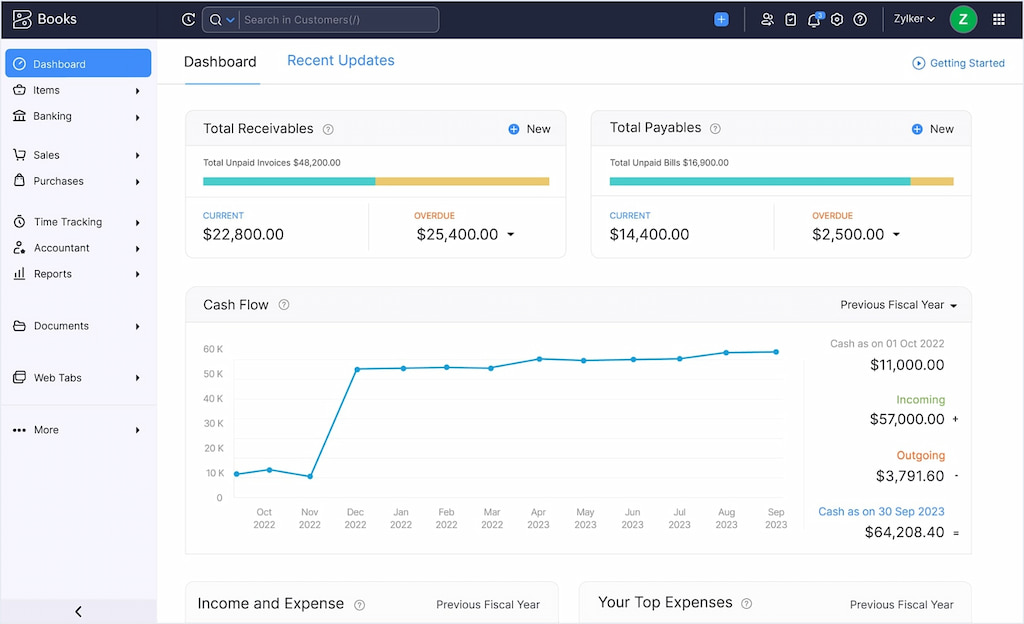

| Zoho Books | Best for automation lovers | ✅ (limited) | ✅ | Tech, SaaS, startups |

| Sage Business Cloud | UK & CA businesses | ❌ | ✅ | International compliance |

| Kashoo | Simple for non-accountants | ❌ | ❌ | Basic bookkeeping |

🆓 Best Free Accounting Software for Small Business

If your budget is $0, start here:

- Wave – 100% free, includes invoicing, expense tracking, and basic reporting

- Zoho Books Free Tier – For businesses under a revenue cap (varies by region)

- ZipBooks – Free tier for one user, basic reporting, solid UI

Wave is the best free accounting software if you want real features and don’t need payroll.

💭 Best Cloud-Based Accounting Software

You want access from anywhere + real-time sync:

- Xero – Pure cloud-native, works well for multiple currencies and locations

- QuickBooks Online – Robust features + deep integrations

- Zoho Books – Built-in workflows, automation, app ecosystem

💰 Best Accounting Software for Payroll & Tax Integration

Don’t want to juggle accounting + payroll tools?

- QuickBooks Online – Seamless QB Payroll add-on

- Zoho Books + Zoho Payroll – Unified under one roof

- Sage – UK & CA payroll compliance

- FreshBooks – Partnered integrations with Gusto

🛒 Best for Retail & eCommerce

Inventory + POS + accounting?

- QuickBooks Online – Shopify, Square, Amazon integrations

- Xero – Good inventory add-ons like DEAR and Unleashed

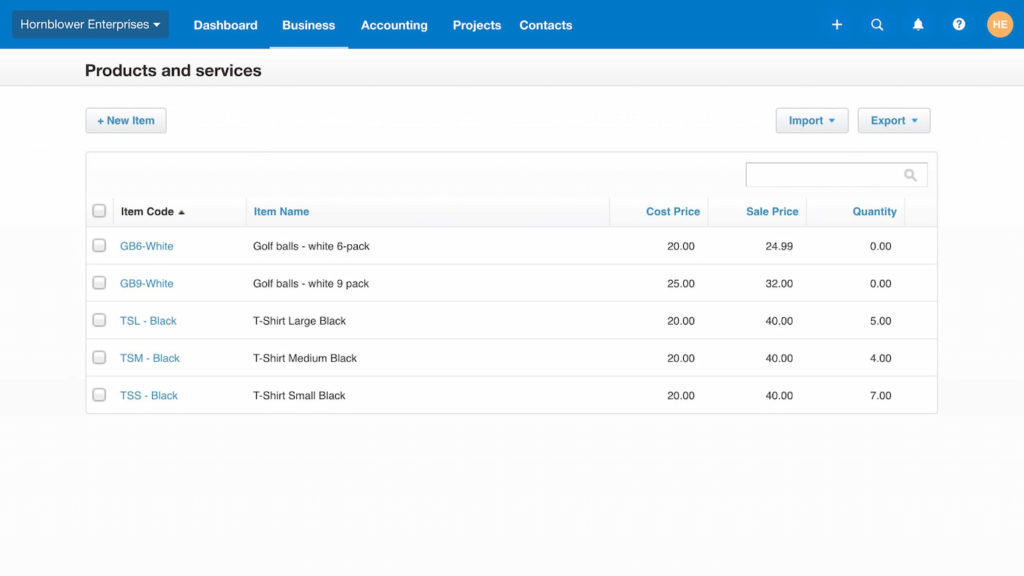

- Zoho Books – Native inventory modules

👷♂️ Best for Construction and Contractors

Project tracking, job costing, and vendor invoicing?

- QuickBooks Online + Projects module

- Sage 100 Contractor (paid, industry-specific)

- Xero – Works if paired with tools like Buildertrend

💻 Best Accounting Software for Mac

All cloud-based tools listed above work well on Mac, but:

- Xero – Cleanest UI on Safari

- FreshBooks – Optimized for freelancers and small teams on macOS

- Zoho Books – Runs anywhere with full browser support

🤔 Best Accounting Software for Startups

You want automation + integrations:

- Zoho Books – Automated workflows, time tracking, and CRM sync

- Xero – SaaS-friendly, with developer-friendly API

- FreshBooks – Ideal for services and project billing

📚 Best Accounting Tools for Manufacturing & Inventory

- QuickBooks Enterprise – Best for advanced inventory (not cheap)

- Xero + Inventory add-ons – Scales better for lean operations

- Zoho Books – Has native stock, reorder levels, warehouse tools

👩 Best for Freelancers & Solopreneurs

- Wave – 100% free, works out of the box

- FreshBooks – Easy invoicing + time tracking

- Zoho Books Free Tier – Includes client portals and estimates

❓ FAQs

1. What is the best accounting software for small business overall?

QuickBooks Online for all-in-one coverage. Wave if you’re on a budget. Zoho Books for automation.

2. What’s the best free small business accounting software?

Wave is the most feature-rich free option right now.

3. Which tool integrates with payroll and tax automation?

QuickBooks, Zoho Books, and FreshBooks (via Gusto) offer excellent payroll/tax sync.

4. What’s best for construction or job costing?

QuickBooks + Projects module, or Sage if you need industry-specific compliance.

5. What if I have zero accounting knowledge?

Start with Wave or Kashoo. Clean, simple, no jargon.

🔎 Final Word

The best accounting software for your small business depends on your size, industry, and budget. For most, QuickBooks Online remains the top contender for all-in-one power.

But if you want free tools, Wave dominates. And if you’re automating everything from CRM to payroll, Zoho Books is the sleeper pick. Pick the one that gets out of your way — and makes taxes less terrifying.

If you like the sound of time tracking, billing, and budgeting, but you also want accounting features in the same place, then why not consider a bookkeeping service that’s compatible with Everhour, such as Quickbooks, Freshbooks, or Xero? Make sure to check out one of the best time tracking apps, best time clock software for small businesses, and best time and attendance software around!

Learn about the best time tracking software for accounting firms here!