Knowing how to keep track of business expenses is key for any business owner. Accurate tracking helps you monitor profits, reduce tax stress, control costs, and plan smarter.

- See where your money goes

- Stay ready for tax season

- Catch unnecessary spending

- Make better budgeting decisions

- Prepare for loans or investors

Tracking expenses is easier than ever with cloud tools and automation. From simple spreadsheets to expense management apps that sync with your bank and project software, there are options for every business.

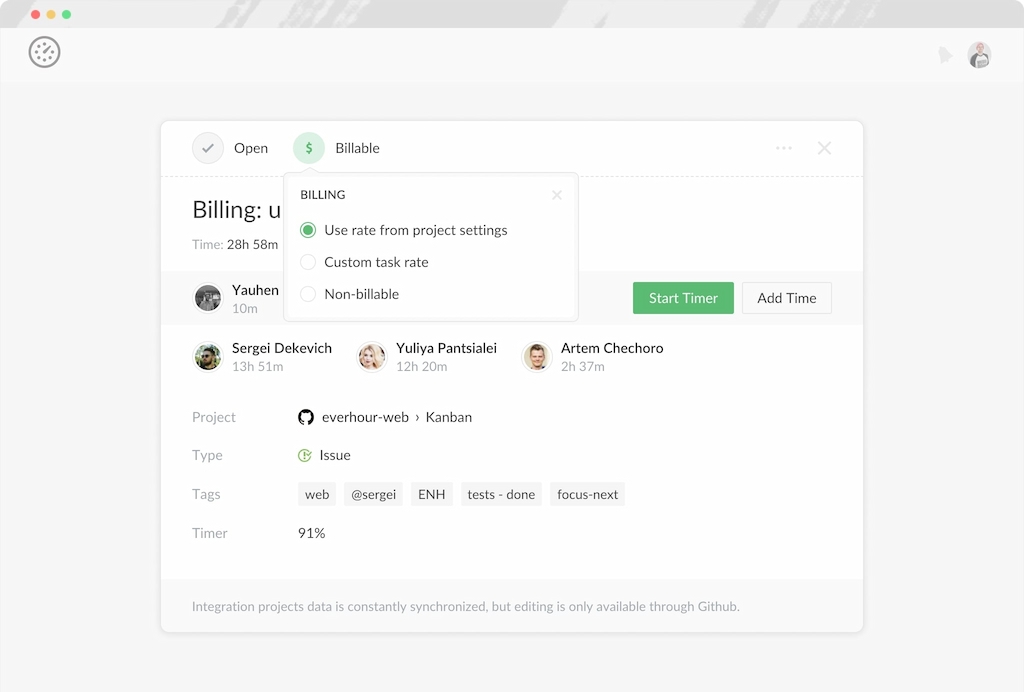

💡 One great option is Everhour, which connects time tracking with budget management and works smoothly with ClickUp, Asana, and more. It helps you link spending directly to projects and client work.

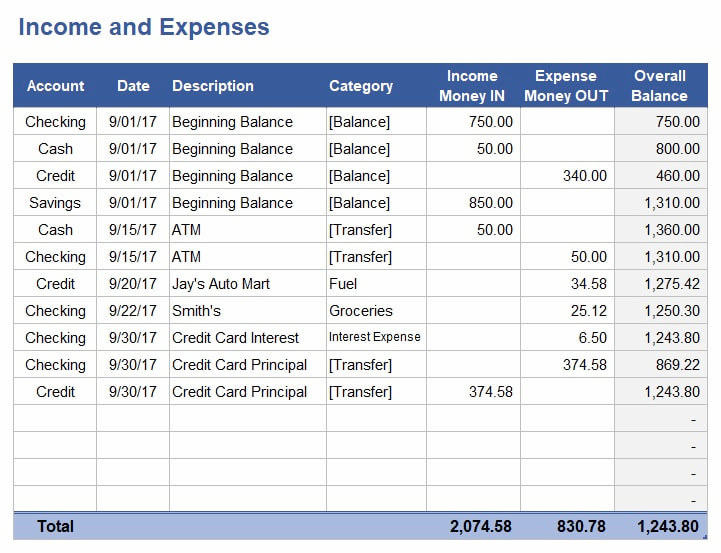

📊 1. Use a Business Expenses Spreadsheet (Excel or Google Sheets)

🎯 Best for: Solo entrepreneurs, freelancers, side hustlers

Spreadsheets are the simplest way to track income and expenses without needing any new tools. You can use Excel, Google Sheets, or download a free template online.

📝 What to include:

- Date of transaction

- Vendor or payee

- Expense category (e.g., travel, software, meals)

- Amount

- Notes or receipts

- Payment method (cash, credit, bank transfer)

✅ Pros:

- Free

- Fully customizable

- Easy to share with an accountant

- Simple to learn with minimal training

⚠️ Cons:

- Manual entry can be time-consuming

- Easy to make mistakes or forget transactions

- Limited automation unless paired with add-ons or scripts

If you’re starting out and your expense volume is low, spreadsheets are a great way to stay organized without committing to a subscription. Once transactions become more frequent or complex, it may be time to switch to a dedicated app.

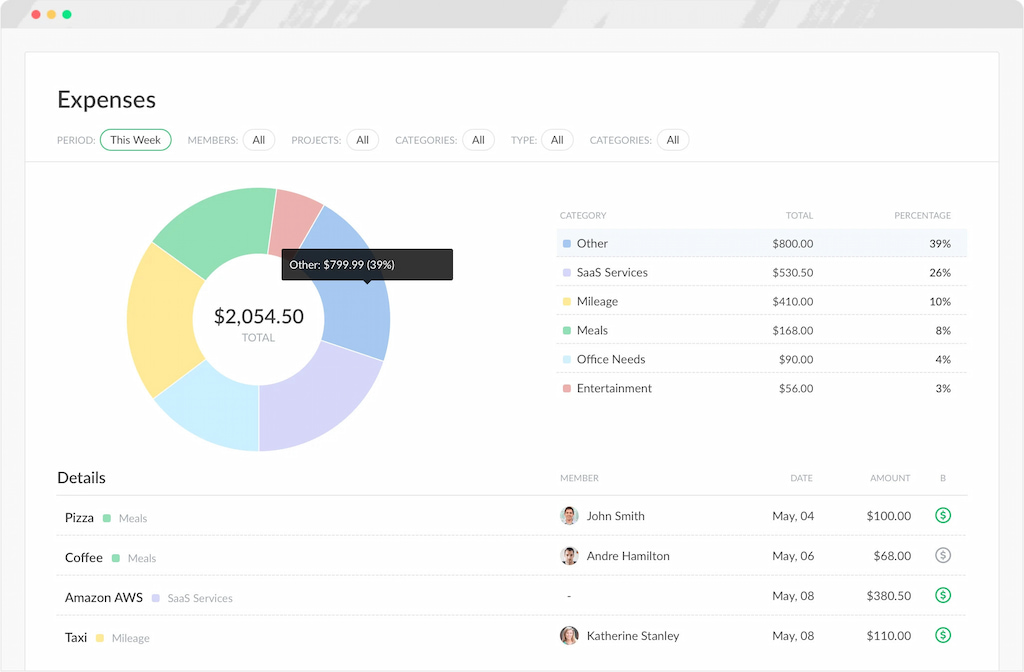

📱 2. Use a Business Expense Tracking App

🎯 Best for: Growing teams, mobile-first users, real-time syncing

Time and expense management apps like Expensify, QuickBooks, or FreshBooks automate tracking by syncing with your bank account, categorizing expenses, and generating reports.

🛠️ Top apps:

- Everhour — Syncs with project management tools and tracks billable hours and expenses. Starts at $8.50/month.

- Expensify — Good for receipt scanning and employee reimbursements. Free for up to 25 SmartScans/month.

- QuickBooks — Full accounting software with robust expense tracking. Starts at $15/month.

- FreshBooks — Designed for freelancers and small teams. Pricing begins at $17/month.

- Wave — A free option for small businesses with solid expense tools.

✅ Pros:

- Saves time with automation

- More accurate data

- Integrates with accounting and payroll platforms

- Often includes dashboards and alerts

⚠️ Cons:

- Monthly subscription fees

- Can be overkill for very small businesses or solo operators

💡 Bonus: Everhour’s time tracker + expense tracking combo helps teams stay on budget, link expenses to tasks or projects, and avoid overbilling clients. With integrations across tools like ClickUp, Asana, Trello, and GitHub, Everhour makes real-time financial tracking seamless.

📂 3. Keep Personal and Business Expenses Separate

This one’s non-negotiable. Use a dedicated bank account and credit card for all business transactions.

❓ Why it matters:

- Simplifies bookkeeping

- Makes IRS audits smoother

- Avoids commingling funds (a legal risk for LLCs and corporations)

- Helps you track cash flow accurately

💡 Tips:

- Open a business checking account

- Apply for a business credit card with cash back on relevant purchases

- Never use personal accounts for business purchases (or vice versa)

If you’re still using your personal card for business purchases, set up a business checking account today — it’s one of the easiest ways to stay financially organized.

📷 4. Save and Categorize Receipts

Whether you’re using a spreadsheet or an app, receipts matter — especially if you want to deduct business expenses come tax season.

❗ Best practices:

- Scan receipts using your phone (most expense apps include this)

- Categorize them by type (e.g., travel, meals, office supplies)

- Store digital backups in the cloud (Google Drive, Dropbox, OneDrive)

- Create folders by month or quarter for quick reference

- Keep original paper copies if required by your tax authority

🧾 5. Review Expenses Monthly

Consistency is key. Set a monthly calendar reminder to:

- Reconcile your bank account and credit card statements

- Categorize new transactions and double-check entries

- Flag duplicate or suspicious charges

- Export reports if needed for tax prep or investor updates

- Monitor spending trends to identify cost-saving opportunities

🔍 You can’t fix what you don’t see. Reviewing expenses regularly helps you stay ahead of budget overruns or financial mistakes.

💼 Project-Based Expense Tracking with Everhour

Need to manage expenses by project or client? Everhour offers project-based tracking features that help you:

- Allocate expenses directly to tasks and clients

- Track billable and non-billable hours

- Monitor budgets in real-time

- Generate detailed reports on profitability

- Eliminate manual entry by syncing with tools like ClickUp, Asana, Trello, and GitHub

Whether you’re an agency, consultant, or freelancer managing multiple projects, Everhour simplifies financial tracking without the need for spreadsheets or separate tools.

🧠 Final Tips: How to Keep Track of Business Expenses

- ⚙️ Automate whenever possible (apps, bank sync, templates)

- 🧠 Don’t rely on memory — log purchases right away

- 💾 Back up your financial data (cloud, local, external)

- 🗂️ Keep categories and templates updated regularly

- 📊 Share reports with your bookkeeper or accountant monthly

- 🧾 Stay tax-ready all year — no more April scrambles

✅ With a solid expense tracking system: you’ll reduce stress, gain clarity, and stay in control of your business finances.

Discover how time tracking improves project profitability by turning every logged hour into smarter decisions and stronger margins.

Learn how to align payroll, budgets, and client billing without spreadsheets—and simplify your entire workflow today.