Exploring the dynamics of payroll schedules opens a window into the financial cadence of our working lives. Among the terms often encountered are “semi-monthly pay” and “bi-weekly pay,” each with its own set of implications. Navigating these intricacies can significantly impact the management of one’s finances. In this article, we’ll break down the basics of semi-monthly pay and compare it with the bi-weekly counterpart. Navigate these payroll structures with us!

What Is a Semi-Monthly Pay?

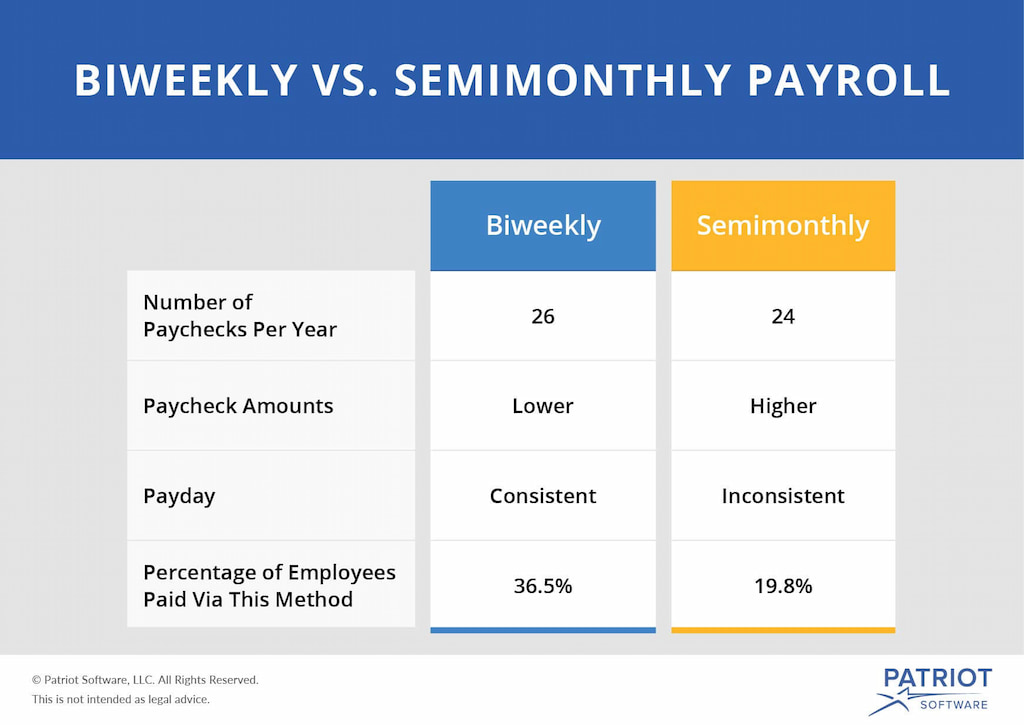

Understanding what is semi-monthly pay generally involves grasping the frequency and structure of pay periods. In essence, what a semi-monthly pay period is that employees receive their wages twice a month. The key distinction lies in the fixed schedule – payments occur on specific dates each month. Unlike bi-weekly pay, where there are 26 pay periods in a year, semi-monthly schedule results in 24 pay periods annually.

Each semi-monthly pay period covers half a month’s work, typically spanning from the 1st to the 15th and the 16th to the end of the month. This arrangement also offers a consistent routine, making it easier for employees to budget and plan expenses.

Semi-monthly pay relies on accurate work hour recording and attendance monitoring, where a time tracker plays a pivotal role. This ensures a streamlined payroll process, fostering efficiency and transparency in the payment cycle.

What Is a Biweekly Pay?

Shifting gears to bi-weekly pay, this payroll structure brings its rhythm to the financial table. Unlike a semi-monthly schedule, bi-weekly pay involves receiving wages every two weeks, resulting in 26 pay periods annually. The distinctive feature here is the flexibility of paydays, occurring every 14 days, usually on the same weekday.

Bi-weekly pay spans a range of dates, accommodating variations in the number of workdays per month. This dynamic schedule can make budgeting a bit more challenging than the predictability of semi-monthly pay.

What Is the Difference Between Semi-Monthly Pay vs Biweekly Pay?

Delving into the distinctions between semi-monthly and bi-weekly pay reveals nuanced differences that can significantly impact financial planning.

1️⃣ Firstly, the cadence sets them apart. Semi-monthly pay follows a fixed schedule with two paydays each month, typically on specific dates like the 1st and 15th. In contrast, bi-weekly pay occurs every two weeks, leading to 26 pay periods annually, but with variable payday dates.

2️⃣ Secondly, the structure of pay periods differs. Semi-monthly pay divides the month into two equal parts, covering the 1st to the 15th and the 16th to the end of the month. Bi-weekly pay, however, doesn’t adhere to a fixed date range, making it more adaptable to varying workdays within a month.

3️⃣ Another notable distinction lies in the number of pay periods per year. Semi-monthly pay results in 24 pay periods, while bi-weekly pay yields 26. This variance can impact annual earnings and affect budgeting strategies.

4️⃣ Lastly, the predictability of semi-monthly pay stands out. Employees can reliably anticipate their paydays, aiding in budget planning. Bi-weekly pay, with its varying payday dates, may require a more flexible approach to financial management.

Understanding these differences empowers individuals and employers to choose the payroll schedule that aligns best with their financial needs and preferences. You should also consider imputed income as it adds another layer to these financial considerations.

The semi-monthly pay structure can also influence how individuals manage their marginal revenue – the additional income from extra work. Moreover, understanding this relationship is key to optimizing financial strategies.

What Pay Schedules Do Different Industries Use?

In some industries, such as retail and hospitality, where workforce management and consistent cash flow are critical, semi-monthly pay is commonly adopted. This regular and predictable schedule aligns well with the needs of employees and employers in these fast-paced environments.

On the other hand, industries with a strong emphasis on project-based work, like consulting or freelancing, often favor bi-weekly pay. The flexibility in payday dates accommodates the irregular nature of project timelines, providing a more adaptable approach to compensation.

Certain sectors, such as healthcare or government, may have standardized payroll practices, utilizing either semi-monthly or bi-weekly schedules depending on organizational policies and budgeting requirements.

Individuals entering specific industries need to be aware of the prevalent pay schedule, as it can significantly impact their financial planning.

Pros and Cons of Semi-Monthly vs Bi-Weekly Payroll

Examining the pros and cons of semi-monthly versus bi-weekly payroll provides valuable insights for both employers and employees navigating the complexities of compensation structures.

✅ Pros of semi-monthly payroll

- Predictability: It offers a consistent and predictable payday, making it easier for employees to plan and budget with certainty.

- Ease of administration: The fixed schedule simplifies payroll administration, reducing the administrative burden on employers.

- Month alignment: The pay periods align with calendar months, simplifying accounting and financial reporting processes.

❌ Cons of semi-monthly payroll

- Varying workdays: In months with varying workdays, employees may receive different amounts, potentially impacting budgeting efforts.

- Less flexibility: The fixed schedule may be less adaptable to industries with fluctuating work hours or irregular project timelines.

✅ Pros bi-weekly payroll

- Regular paydays: Employees receive a paycheck every two weeks, providing a steady flow of income throughout the year.

- Accommodates varying workdays: Bi-weekly pay is more flexible in accommodating months with varying workdays, ensuring a consistent payday.

- Increased pay periods: With 26 pay periods annually, employees receive paychecks more frequently, potentially benefiting those who prefer a shorter pay cycle.

❌ Cons of bi-weekly payroll

- Budgeting challenges: The variable payday dates may pose challenges for employees accustomed to a fixed schedule, requiring a more adaptable budgeting approach.

- Administrative complexity: Managing 26 pay periods can introduce additional administrative complexities for employers, particularly in terms of budgeting and forecasting.

Understanding these pros and cons certainly allows individuals and organizations to weigh the trade-offs and choose the payroll schedule that aligns best with their financial goals and operational needs.

Summary

| Aspect | Pros of semi-monthly pay | Cons of semi-monthly pay |

| Pay frequence | Predictable and consistent payday | Varying workdays may lead to fluctuating pay |

| Administrative ease | Simplified payroll administration | Less flexibility for industries with irregular hours |

| Month alignment | Aligns with calendar months, facilitating accounting | Potential budgeting challenges in varying workdays |

| Financial planning | Employees can plan and budget with certainty | – |

Conclusion

In conclusion, the choice between semi-monthly and bi-weekly schedules is a pivotal decision with far-reaching implications for both employers and employees. Each payroll structure obviously brings its own set of advantages and challenges, catering to diverse industry needs and individual preferences.

Summing up, the best-fit payroll schedule depends on the nature of the work, financial planning preferences, and the industry’s operational demands. As businesses and employees navigate these choices, a nuanced understanding of the pros and cons of each approach generally empowers informed decision-making.

In case you are managing a team of 5 or more and looking to boost efficiency, Everhour is the perfect tool to keep your team on track. With seamless time tracking, you can easily estimate task durations, set clear budgets, and generate detailed reports inside Asana, Trello, Jira, or any other pm tool.

Discover why most teams burn budget without realizing it, and how you can fix it with data—not guesswork.