Managing company expenses manually is time-consuming, error-prone, and difficult to scale. An automated expense approval workflow makes it easy to submit, track, and approve expenses efficiently, with full visibility and control.

In this guide, we’ll break down how a typical expense approval process works, why automation is essential, and how to set up a simple workflow using tools like Monday.com, Trello, or other workflow platforms.

✅ What Is an Expense Approval Workflow?

An expense approval workflow is a structured process used by businesses to review and authorize expenses before reimbursing employees. This ensures that all costs are within policy and correctly documented before company funds are disbursed.

It typically includes:

- Submission of an expense report

- Review by a manager or finance team

- Approval or rejection

- Reimbursement processing

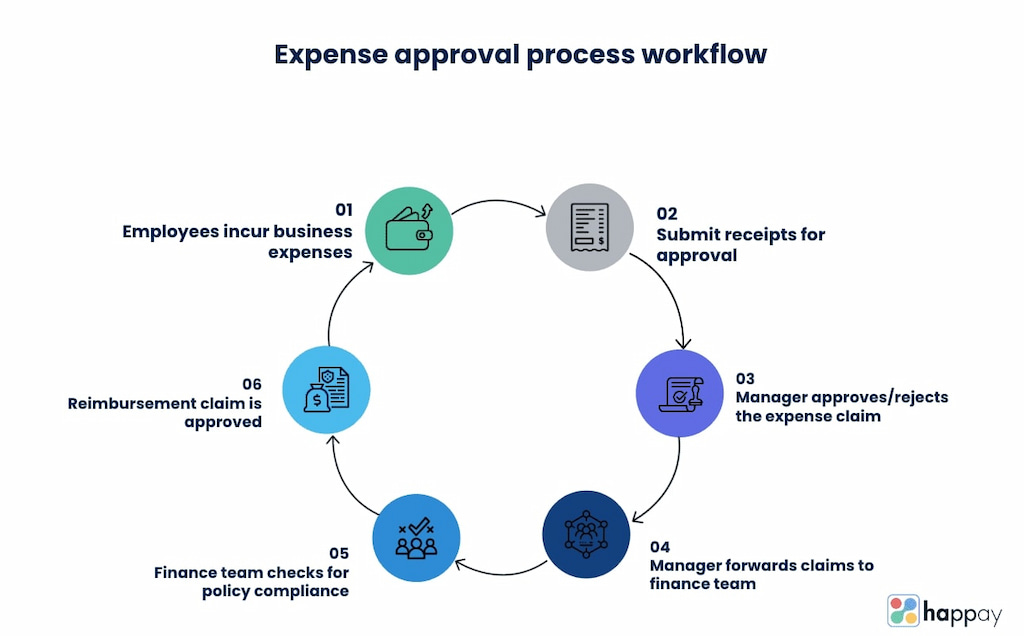

🔁 Stages in a Typical Expense Approval Process

| Stage | Description |

|---|---|

| 📝 Submission | Employee submits an expense report with receipts and category details. |

| 👨💼 Manager review | Direct manager reviews for validity and alignment with budget. |

| 💰 Finance approval | Finance verifies policy compliance and accounting accuracy. |

| ✅ Reimbursement | Approved expenses are reimbursed or logged in payroll. |

🛠️ How to Automate an Expense Approval Workflow

Manual workflows are slow and difficult to audit. Here’s how to automate your expense approval using tools like Monday.com, Airtable, or Notion.

Steps to build an automated workflow

| Step | Automation example |

|---|---|

| 📋 Create a form or board | Use Monday Forms, Google Forms, or Airtable to capture expenses |

| ⚙️ Define triggers | “When a form is submitted” → start approval workflow |

| 🧾 Add conditions | If the amount > $500 → assign to Finance Manager |

| 📣 Automate notifications | Notify the manager on Slack or via email |

| 🕓 Record approval history | Log every status update with timestamp |

Check out our list of the best expense trackers out there!

💼 Real-World Use Case Examples

| Stage | Description |

|---|---|

| 📝 Submission | Employee submits an expense report with receipts and category details. |

| 🔍 Manager review | Direct manager reviews for validity and alignment with budget. |

| 💰 Finance approval | Finance verifies policy compliance and accounting accuracy. |

| 🏦 Reimbursement | Approved expenses are reimbursed or logged in payroll. |

🧠 Benefits of Automating Your Expense Report Approval Workflow

- ⏰ Saves time: No more back-and-forth emails or spreadsheets

- 🔍 Improves visibility: Audit logs track every step of approval

- 🧾 Ensures compliance: Automatically reject out-of-policy expenses

- 📊 Easy reporting: Export data for accounting or audits

🔄 FAQ: Expense Approval Workflow

Can I automate approvals based on the amount?

Yes. You can set up conditional logic to escalate approvals based on value thresholds.

What if an expense is missing receipts?

You can build logic that prevents submission without mandatory file attachments.

Which tools support expense approval automation?

Tools like Monday.com, Airtable, Asana, Notion, and Zapier all support workflow automation.

Can I integrate expense approval with accounting software?

Yes. Most platforms integrate with QuickBooks, Xero, FreshBooks, and payroll tools.

To streamline your workflow, focus on clarity, automation, and consistency. A well-defined process reduces delays and errors—saving your team time and frustration. A time tracker like Everhour can help by adding time tracking and approval visibility to the mix.