California Labor Laws 2026: Your Complete Guide to Employee Rights and Compliance

California is known for having some of the most comprehensive and protective labor laws in the United States. These laws are designed to safeguard workers’ rights, ensuring fair treatment, proper compensation, and a safe working environment. Understanding the intricacies of labor laws in California is essential for navigating the workplace effectively.

In this article, we’ll explore key aspects of California labor laws, providing a clear guide to help you understand your rights and responsibilities in the Golden State’s workforce. If you seek to ensure compliance as an employer or protect your rights as an employee, this article will equip you with the knowledge you need.

Employment Classification Under California Labor Laws

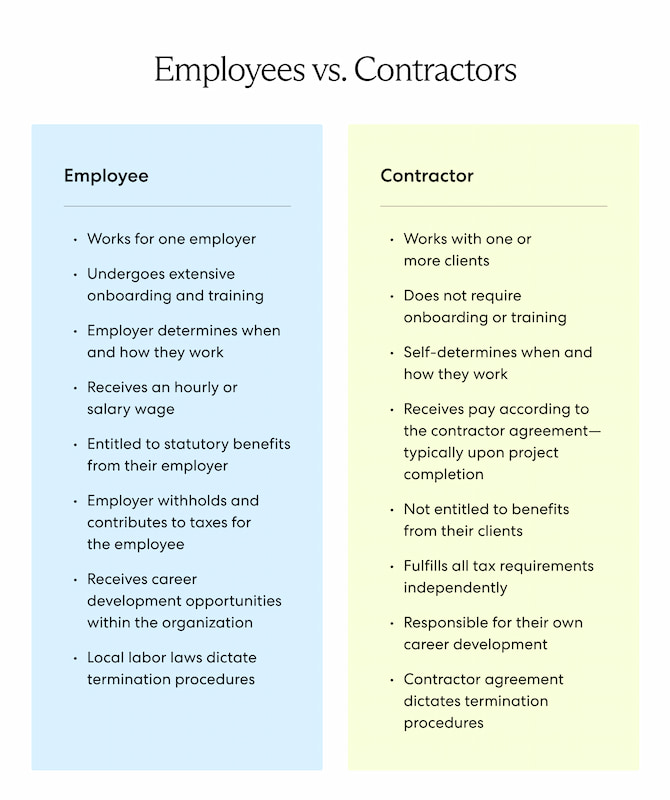

Employee vs. Independent contractor

One of the most critical distinctions in the California certified payroll laws is between employees and independent contractors. This classification affects everything from tax obligations to eligibility for benefits like health insurance, overtime pay, and unemployment insurance.

1️⃣ Employees: Typically, employees work under the direction and control of their employer, who provides the tools, resources, and environment necessary for them to perform their jobs. Employees are entitled to protections under California labor laws, including minimum wage, overtime pay, meal and rest breaks, and the right to a safe workplace.

2️⃣ Independent contractors: Independent contractors, on the other hand, operate their own businesses and are hired to complete specific tasks or projects. They have more control over how and when they work and typically supply their tools and resources. Independent contractors do not receive the same protections as employees and are responsible for their own taxes and benefits.

California uses the “ABC Test” to determine whether a worker is an employee or an independent contractor. Under this test, a worker is considered an employee unless they meet all three of the following conditions:

- Autonomy: The worker is free from the control and direction of the hiring entity in connection with the performance of the work.

- Business service: The worker performs tasks that are outside the usual course of the hiring entity’s business.

- Independent trade: The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed for the hiring entity.

If any of these criteria are not met, the worker is classified as an employee, not an independent contractor.

Exempt vs. non-exempt employees

Another critical classification in California work laws is the distinction between exempt and non-exempt employees, which primarily impacts an employee’s eligibility for overtime pay and other protections.

1️⃣ Exempt employees: These employees are typically salaried and hold roles that are executive, administrative, or professional in nature. Exempt employees are not entitled to overtime pay or meal and rest breaks under California law. To qualify as exempt, an employee must meet certain salary thresholds (read about average salary in California) and perform specific job duties that involve decision-making, management, or specialized knowledge.

2️⃣ Non-exempt employees: Non-exempt employees are usually paid hourly and are entitled to overtime pay for any hours worked over eight in a day or 40 in a week. They also have the right to meal and rest breaks. Non-exempt status is common for most hourly workers who do not meet the criteria for exempt classification.

Misclassification can result in significant legal penalties, including back pay for unpaid overtime. To navigate these complexities and ensure accurate classification, effective time tracking becomes essential.

Understanding California Wage Laws

California state labor laws are comprehensive and designed to protect employees by ensuring fair compensation. These laws cover a wide range of issues, from minimum wage rates to specific rules for tipped workers, food delivery businesses, and exceptions for certain types of employment.

Minimum wage

California has some of the highest minimum wage rates in the country, reflecting the state’s high cost of living and its commitment to fair pay.

- State minimum wage: As of 2024, the state minimum wage is $16 per hour for all employees. This applies regardless of the size of the employer, ensuring a consistent baseline for worker pay across the state.

- Local wage ordinances: In addition to the state minimum, many cities and counties in California have enacted their own minimum wage laws, often setting rates higher than the state standard. For instance, San Francisco and Los Angeles have minimum wages that exceed $16 per hour. Employers in these areas must comply with the higher local rates.

- Annual adjustments: The state minimum wage is subject to annual increases based on inflation and other economic factors. This ensures wages keep pace with the rising cost of living.

Tipped minimum wage

Unlike many other states, California does not allow a lower minimum wage for tipped employees.

- Full minimum wage for tipped employees: In California, tipped workers, including servers, bartenders, and other hospitality workers, must be paid the full state minimum wage of $16 per hour. Employers are not permitted to count tips toward meeting the minimum wage requirement.

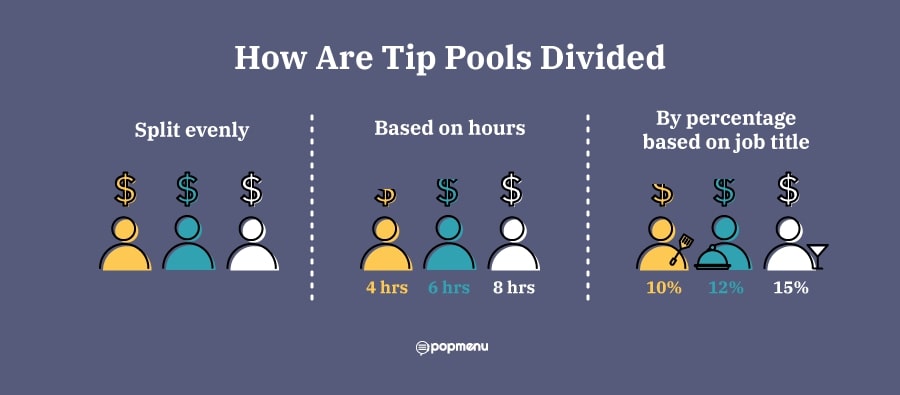

- Tip pooling: Employers may implement tip pooling arrangements where tips are shared among employees. However, management cannot participate in the tip pool, and all employees involved must be engaged in tasks that directly interact with customers.

Food delivery business considerations

For food delivery workers, especially those employed by gig economy companies like UberEats, DoorDash, or Postmates, California law has specific implications:

- AB 5 and worker classification: Under California’s Assembly Bill 5 (AB 5), many food delivery drivers may be classified as employees rather than independent contractors. This classification affects their eligibility for minimum wage, overtime, and other labor protections. Companies must ensure compliance with this law or potentially face legal consequences.

- Reimbursement for expenses: If classified as employees, food delivery workers are entitled to reimbursement for necessary expenses incurred during their work, such as mileage or vehicle maintenance.

Exceptions to minimum wage

While the general rule in California is that all employees are entitled to the state minimum wage, there are exceptions:

- Learners: Employees who are 18 years old or younger and have no prior experience in the occupation can be paid 85% of the minimum wage during their first 160 hours of employment.

- Disabled workers: Certain workers with disabilities may be paid less than the minimum wage under special licenses issued by the state. These licenses are intended to provide employment opportunities to individuals who might not otherwise be able to compete in the job market.

- Student employees: Full-time students employed by their educational institutions can be paid 85% of the minimum wage for part-time work, as long as the work does not exceed 20 hours per week.

- Camp counselors and other seasonal workers: Specific rules apply to camp counselors and other seasonal workers, who may receive a weekly salary rather than an hourly wage (learn the difference between salary vs wage here). However, the salary must still meet the minimum wage when divided by the number of hours worked.

Subminimum wage

In some limited cases, employers are allowed to pay a subminimum wage, which is below the standard minimum wage.

- Apprenticeships and internships: Registered apprentices and some interns may be paid a subminimum wage if the position meets certain educational and training criteria. The goal is to provide valuable work experience rather than just compensation.

- Youth minimum wage: The federal Fair Labor Standards Act (FLSA) allows employers to pay workers under 20 years of age a subminimum wage of $4.25 per hour during their first 90 consecutive calendar days of employment. However, California law requires adherence to the state minimum wage, so this lower federal rate does not apply in most cases.

- Training wage: California does not generally allow for a training wage lower than the state minimum wage, except for the specific learner provision mentioned earlier.

Wage payment rules

In addition to minimum wage requirements, California pay laws also set strict rules about how and when wages must be paid.

- Pay periods: Employers must establish regular pay periods and must pay employees at least twice per month. Wages earned between the 1st and 15th of the month must be paid by the 26th, and wages earned between the 16th and the last day of the month must be paid by the 10th of the following month.

- Final wages: When an employee is terminated, they must receive their final paycheck, including all earned wages, immediately upon termination. If an employee resigns with at least 72 hours’ notice, final wages must be paid on the employee’s last working day. If the employee resigns without notice, final wages must be paid within 72 hours.

- Wage statements: Employers are required to provide employees with an itemized wage statement for each pay period. This statement must include specific information, such as the total hours worked, the hourly rate, deductions, and net wages earned.

Equal pay

California is also at the forefront of ensuring wage equality among its workforce.

- ❗ California Equal Pay Act: Under this act, employers are prohibited from paying employees of one sex less than employees of the opposite sex for substantially similar work. This law also extends to race and ethnicity, aiming to eliminate wage disparities in the workplace.

- ❗ Salary history ban: California law prohibits employers from asking job applicants about their salary history or using that information to determine what salary to offer. This law is designed to help close the wage gap by ensuring that past earnings do not determine future pay.

California Overtime Laws: What You Need to Know

California’s overtime laws are designed to ensure that employees are fairly compensated for extra hours worked. Here’s a detailed overview of how these laws work:

Definition of overtime

In California, overtime pay is mandated for work beyond standard hours. Key definitions include:

- Daily overtime: Employees are entitled to overtime pay at a rate of one and a half times their regular rate of pay for all hours worked over 8 in a single workday.

- Double time: Employees receive double their regular rate of pay for hours worked over 12 in a single workday or for hours worked beyond 8 hours on the seventh consecutive day of work in a workweek.

Who is eligible for overtime

Most non-exempt employees are covered by California’s overtime laws. Eligibility criteria include:

- Non-exempt employees: These are employees who do not fall under specific exemptions and perform duties that are not managerial or administrative. They include workers in manual labor, service, clerical, and technical roles.

-

Exempt employees: Certain employees may be exempt from overtime requirements. This includes:

- Executive, administrative, and professional employees: These individuals must perform job duties that involve management or significant discretion and must meet a minimum salary threshold.

- Highly compensated employees: Those who earn above a designated salary level and perform exempt duties are also generally excluded from overtime pay.

Calculating overtime pay

Overtime compensation is based on the employee’s regular rate of pay and is calculated as follows:

- Regular overtime pay: Calculated at 1.5 times the regular hourly rate for hours worked over 8 in a workday.

- Double time pay: Calculated at 2 times the regular hourly rate for hours worked over 12 in a workday or for hours worked beyond 8 hours on the seventh consecutive day in a workweek.

Enforcement and compliance

Employers must adhere to California’s overtime regulations to avoid legal consequences and ensure fair employee compensation. Employees who suspect they are not receiving proper overtime pay can:

- File a claim: With the California Division of Labor Standards Enforcement (DLSE).

- Seek legal recourse: Through the court system if necessary.

California Break Laws

In California, break laws are designed to ensure that employees have adequate rest and meal periods during their workday. Understanding these regulations helps both employers and employees comply with state requirements and promote a healthy work environment.

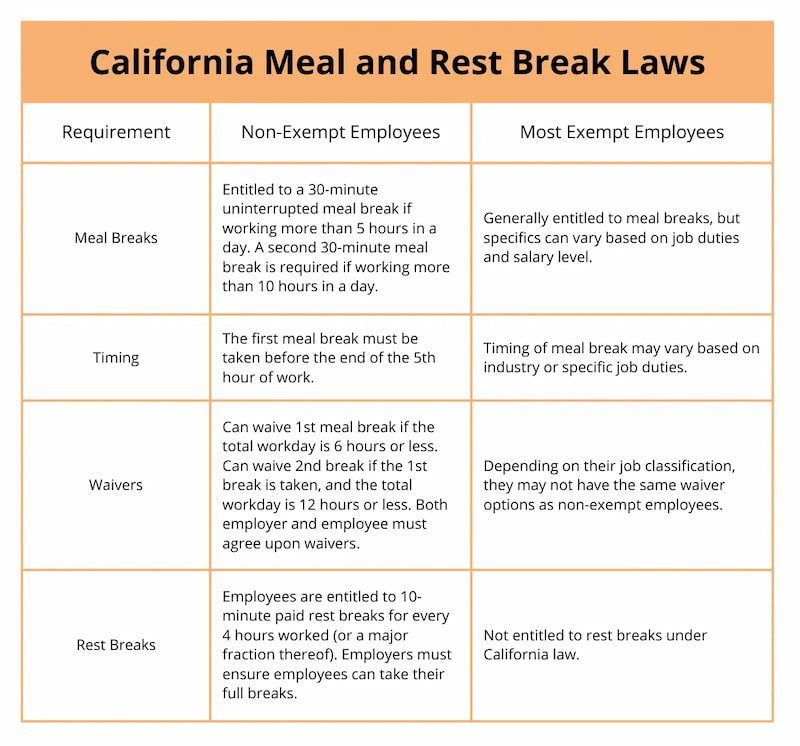

Meal breaks

California working laws mandate that employees are entitled to meal breaks under specific conditions:

- Timing of meal breaks: Employees who work more than 5 hours in a workday must be provided with a 30-minute unpaid meal break. This break must be taken no later than the end of the employee’s fifth hour of work.

- Paid meal breaks: If the employee’s workday exceeds 10 hours, they are entitled to a second 30-minute unpaid meal break.

- Waivers: If an employee’s shift is no longer than 6 hours, they may choose to waive the meal break by mutual consent. However, if an employee’s shift is longer than 12 hours, the second meal break cannot be waived.

Rest breaks

California law also outlines requirements for rest breaks:

- Break timing: Employees are entitled to a 10-minute paid rest break for every 4 hours worked or a major fraction thereof. Rest breaks should be taken roughly in the middle of each work period.

- Rest break compensation: Rest breaks are considered paid time and should be included in the employee’s regular rate of pay.

- Breaks for minors: Additional regulations apply to minors regarding rest and meal breaks, which generally follow similar guidelines but may have specific provisions for shorter work periods and different scheduling.

Breastfeeding breaks

Payroll laws in California provide additional protections for breastfeeding employees:

- Breaks for breastfeeding: Employees who need to express breast milk during the workday are entitled to a reasonable amount of time to do so. Employers must provide a private space, other than a bathroom, for this purpose.

- Compensation for breaks: Breastfeeding breaks are not considered part of the employee’s paid rest breaks or meal periods. Employees must be compensated for time spent breastfeeding if it coincides with their paid rest break. If the time spent exceeds the allotted rest break, it is unpaid.

- Flexible schedules: Employers are encouraged to accommodate flexible scheduling to support breastfeeding employees, allowing them to take necessary breaks without penalty.

Additional considerations

- On-duty meal breaks: In cases where the nature of the work prevents employees from being relieved of all duties, employers may provide on-duty meal breaks. These breaks must be paid, and the employee must consent to this arrangement in writing.

- Consequences of non-compliance: Employers who fail to provide required meal and rest breaks, including breastfeeding accommodations, may be liable for additional compensation. For each workday a required break is not provided, employees may be entitled to one additional hour of pay at their regular rate.

By adhering to California’s break laws, including those related to breastfeeding, employers can foster a supportive and inclusive work environment. Employees can ensure they are receiving the rest, meal periods, and accommodations they are entitled to for maintaining health, productivity, and well-being.

California Leave Laws

California provides a range of leave options to support employees in managing their personal, family, and health-related needs. Here’s an overview of the key types of leave:

Paid sick leave

- Accrual: Employees earn one hour of paid sick leave for every 30 hours worked. Alternatively, employers may provide a lump sum of 24 hours of paid sick leave at the start of each year.

- Usage: Paid sick leave can be used for personal illness, family member illness, preventive care, or issues related to domestic violence, sexual assault, or stalking.

- Carryover: Employees can carry over unused sick leave to the next year, but employers may cap accrued leave at 48 hours or 6 days.

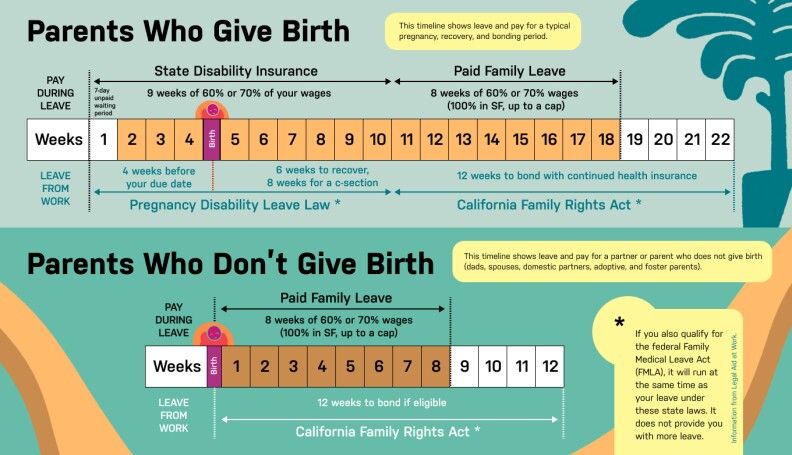

Family and medical leave (CFRA and FMLA)

- Eligibility: Employees qualify for CFRA and FMLA leave if they have worked at least 1,250 hours in the past 12 months at a location with 50 or more employees within a 75-mile radius.

- Leave duration: Eligible employees can take up to 12 weeks of unpaid leave within a 12-month period for reasons such as the birth of a child, adoption, or their own serious health condition. CFRA also covers the serious health conditions of a family member.

- Job protection: Employees are entitled to return to their same or equivalent position after their leave.

Pregnancy disability leave (PDL)

- Eligibility: Employees disabled by pregnancy, childbirth, or related medical conditions are eligible for PDL, which applies regardless of the employer’s size.

- Leave duration: Up to 4 months (17.3 weeks) of leave is available, depending on the disability’s length.

- Job protection: Employees can return to their same or equivalent position after taking PDL.

California family rights act (CFRA)

- Leave for family care: CFRA provides up to 12 weeks of leave in a 12-month period to care for a family member with a serious health condition.

- Leave for bonding: CFRA includes leave for bonding with a new child, which can be taken in conjunction with pregnancy disability leave or separately.

Organ and bone marrow donation leave

- Organ donation: Employees are entitled to up to 30 days of paid leave per year for organ donation.

- Bone marrow donation: Employees can take up to 5 days of paid leave per year for bone marrow donation.

- Job protection: Employees are guaranteed their same or equivalent position upon return from donation leave.

Bereavement leave

- Company policies: California does not mandate bereavement leave, but many employers offer it as part of their benefits. Policies vary, so employees should consult their company’s handbook or HR department.

Military leave

- Military service: Employees serving in the U.S. military are entitled to up to 17 days of unpaid leave per year for training and active duty.

- Job protection: Employers must reinstate employees to their previous or equivalent positions upon their return from military service.

Workplace Safety and Health

Maintaining a safe and healthy workplace is crucial in California, with strict regulations and guidelines to protect employees. Here’s an overview of key aspects of workplace safety and health:

Occupational Safety and Health Administration (OSHA) regulations

- Employer responsibilities: Employers must provide a safe working environment free from known hazards. This includes following OSHA standards, ensuring proper training, and maintaining equipment.

- Employee rights: Employees have the right to work in a safe environment, receive training on workplace hazards, and report unsafe conditions without fear of retaliation.

- Inspections and citations: OSHA conducts inspections to ensure compliance with safety standards. Violations can result in citations and fines, which vary depending on the severity of the infraction.

Workers’ compensation

- Coverage: Workers’ compensation provides benefits to employees who suffer work-related injuries or illnesses. This includes medical treatment, temporary and permanent disability benefits, and death benefits for dependents.

- Reporting: Employees must report injuries or illnesses to their employer as soon as possible to ensure they receive workers’ compensation benefits. Employers are required to provide claim forms and notify their workers’ compensation insurance carrier.

- Dispute resolution: Disputes over workers’ compensation claims can be resolved through California’s Workers’ Compensation Appeals Board (WCAB), which handles issues like benefit eligibility and the extent of injuries.

Emergency preparedness

- Emergency action plans (EAP): Employers must develop and implement EAPs that include procedures for reporting emergencies, evacuating the workplace, and accounting for all employees after an evacuation.

- Employee training: Employers are required to train employees on the EAP, including roles and responsibilities during an emergency, use of emergency equipment, and how to report incidents.

- Regular drills: Regular emergency drills, such as fire drills and earthquake drills, should be conducted to ensure all employees are familiar with the EAP and can respond appropriately during an actual emergency.

Employment Rights and Protections

California law provides robust protections for employees to ensure a fair and equitable workplace. Below are key areas of employment rights and protections:

Anti-discrimination laws

- Protected characteristics: California prohibits discrimination based on race, color, religion, sex, gender identity, sexual orientation, national origin, age, disability, marital status, military status, and more. These protections apply to hiring, firing, promotions, and other employment decisions.

- Reasonable accommodations: Employers must provide reasonable accommodations for employees with disabilities or religious needs, unless doing so would cause undue hardship to the business.

- Filing complaints: Employees who believe they have been discriminated against can file a complaint with the California Department of Fair Employment and Housing (DFEH) or the Equal Employment Opportunity Commission (EEOC).

Harassment prevention

- Workplace harassment: Harassment based on any of the protected characteristics is illegal in California. This includes sexual harassment and any behavior that creates a hostile work environment.

- Training requirements: California law mandates that employers with five or more employees provide regular anti-harassment training. Supervisors must receive at least two hours of training, while non-supervisory employees require one hour.

- Reporting mechanisms: Employers must have procedures in place for employees to report harassment and ensure that complaints are taken seriously and investigated promptly.

Child Labor Laws

There are strict employee laws in California to protect minors in the workforce, ensuring their education is prioritized and their safety is maintained. Below are the key points regarding child labor:

Work permits

- Minors’ requirements: All minors under 18 years old must obtain a work permit before starting employment. These permits are issued by the minor’s school and must be renewed annually.

- Employer responsibility: Employers must keep a copy of the work permit on file for each minor employee and ensure that they comply with the permitted working hours and conditions.

Working hours and restrictions

- School days: On school days, minors aged 14 and 15 can work up to 3 hours per day and 18 hours per week. Minors aged 16 and 17 can work up to 4 hours per day and 48 hours per week.

- Non-school days: On non-school days, minors aged 14 and 15 can work up to 8 hours per day and 40 hours per week, while minors aged 16 and 17 can work up to 8 hours per day and 48 hours per week.

- Night work: Minors under 18 are generally not allowed to work between 10 p.m. and 5 a.m., with some exceptions for agricultural or entertainment industry work.

Prohibited occupations

- Hazardous work: Minors are prohibited from working in hazardous occupations, including jobs involving heavy machinery, toxic substances, and dangerous tools.

- Restricted industries: Certain industries have additional restrictions for minors, such as construction, manufacturing, and mining, due to the higher risks involved.

Education and work balance

- School attendance: Minors are required to attend school, and their work hours must not interfere with their education. Employers must accommodate school schedules and cannot schedule work during school hours.

- Work experience education programs: California offers work experience education programs that allow students to gain practical work experience while receiving academic credit. These programs must comply with child labor laws and ensure that student’s education is not compromised.

Termination and Layoffs

Understanding the laws surrounding termination and layoffs in California is crucial for both employers and employees. This section covers the key aspects of employment termination, wrongful termination, and the rules governing layoffs and severance.

At-will employment

- General rule: California is an at-will employment state, meaning that employers can terminate employees at any time, with or without cause, and employees can leave their jobs at any time without reason or notice.

- Exceptions: Despite at-will employment, there are exceptions where termination may be unlawful, such as if it violates an employment contract or public policy, or if it is based on discriminatory reasons.

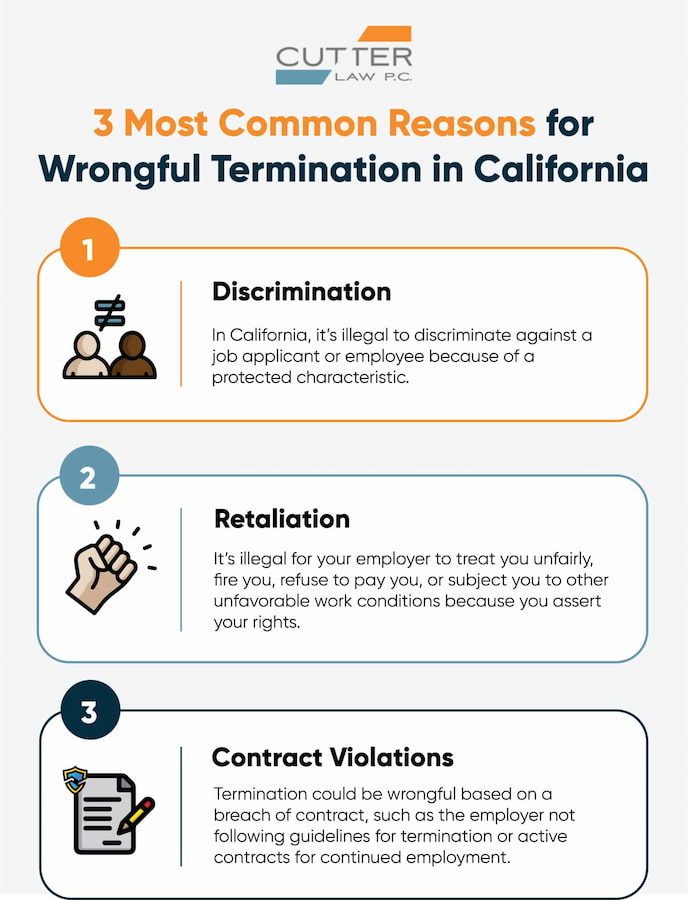

Wrongful termination

- Violation of rights: Wrongful termination occurs when an employee is fired in violation of their legal rights. This includes being terminated for discriminatory reasons (e.g., race, gender, age), retaliation for whistleblowing, or for refusing to engage in illegal activities.

- Legal recourse: Employees who believe they have been wrongfully terminated can file a claim with the California Department of Fair Employment and Housing (DFEH) or pursue a lawsuit against their employer for damages.

Layoff and severance

- Notice requirements: Under the California Worker Adjustment and Retraining Notification (WARN) Act, employers with 75 or more employees must provide at least 60 days’ notice before a mass layoff, relocation, or termination of operations.

- Severance pay: California law does not require employers to provide severance pay unless it is stipulated in an employment contract or company policy. However, severance agreements are common and often include a release of claims against the employer.

- Continuation of benefits: Laid-off employees are entitled to continue their health insurance under COBRA (Consolidated Omnibus Budget Reconciliation Act), which allows them to keep their group health benefits for a limited period after employment ends.

Employee Benefits

Health insurance

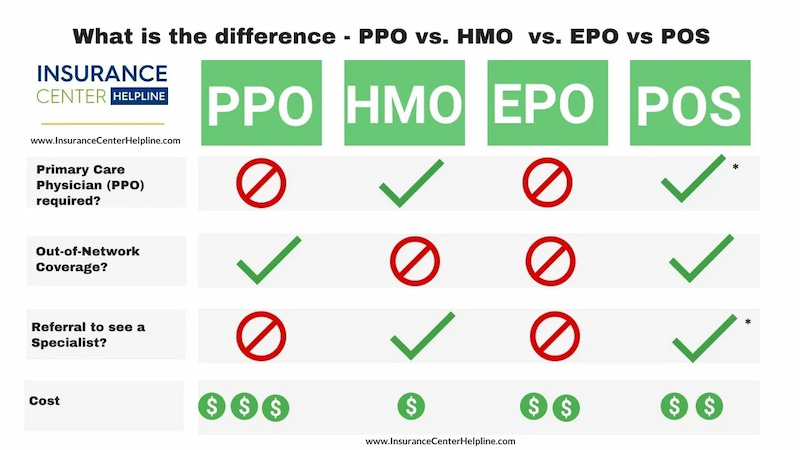

In California, employers with 50 or more full-time employees are required to provide health insurance under the Affordable Care Act (ACA). Many employers offer various plans, including HMOs, PPOs, and high-deductible options, to meet the needs of their workforce. Employees should be informed of their health insurance options during the onboarding process and any annual open enrollment periods.

Retirement plans

Employers in California are encouraged to offer retirement savings plans, such as 401(k)s or pensions, to help employees plan for their future. Some businesses are required to participate in the CalSavers program, which mandates that employers without a retirement plan provide their employees with access to this state-sponsored retirement savings plan. It’s essential for employers to provide clear information about retirement benefits, including matching contributions and vesting schedules.

Other benefits

In addition to health insurance and retirement plans, California employers often provide various other benefits to attract and retain talent. These may include paid time off (PTO), flexible working arrangements, wellness programs, and employee assistance programs (EAPs). Employers must clearly communicate these benefits and any eligibility requirements to their employees, ensuring they understand the full scope of what is available to them.

Labor Relations and Collective Bargaining

Unionization

In California, employees have the right to unionize and collectively bargain with their employers. The state’s labor laws protect employees’ rights to organize, join, or assist unions and engage in activities related to collective bargaining. Employers are prohibited from interfering with these rights, and any attempts to intimidate or retaliate against employees for union activities are illegal. Learn more about right-to-work states here.

Collective bargaining

Collective bargaining is the process through which unions and employers negotiate terms and conditions of employment, such as wages, hours, benefits, and working conditions. In California, collective bargaining agreements (CBAs) are legally binding contracts that outline the rights and responsibilities of both the employer and the unionized employees. These agreements play a crucial role in shaping workplace policies and ensuring fair treatment of workers. Employers must engage in good-faith negotiations with unions to reach mutually agreeable terms.

Legal Resources and Compliance

Legal resources for employees and employers

California offers a range of legal resources to support both employees and employers in understanding and navigating labor laws. Key resources include:

- California Department of Industrial Relations (DIR): Provides information on wage laws, workplace safety, and labor standards.

- California Labor Commissioner’s Office: Assists with wage disputes, claims for unpaid wages, and other labor-related issues.

- Employment Development Department (EDD): Offers resources on unemployment insurance, disability insurance, and paid family leave.

- Legal Aid Organizations: Various non-profit organizations offer free or low-cost legal assistance to employees facing labor law issues.

Compliance best practices

Ensuring compliance with California labor laws is crucial for avoiding legal issues and fostering a fair workplace. Best practices include:

- Stay informed: Regularly update yourself on changes to state and federal labor laws to ensure your policies and practices are current.

- Maintain accurate records: Keep detailed records of employee hours, wages, and any workplace incidents to demonstrate compliance and address disputes.

- Implement clear policies: Develop and communicate clear workplace policies on topics such as overtime, breaks, and discrimination to guide employee behavior and ensure adherence to legal requirements.

- Provide training: Regularly train employees and managers on legal obligations, workplace rights, and company policies to promote a compliant and informed workforce.

- Conduct audits: Periodically review your labor practices and policies to identify and address potential compliance issues before they become problems.

California Labor Laws: Conclusion

Navigating California work laws can be complex, but understanding the essentials—ranging from wage and hour regulations to employee benefits and safety—helps ensure compliance and fosters a positive work environment. Staying informed about your rights and responsibilities is key to maintaining a fair and legally compliant workplace.

For businesses looking to streamline their operations and improve time management, integrating effective tools is essential. Everhour offers a robust solution for tracking time, managing projects, and ensuring that your team remains focused and productive. You can enhance your understanding of work patterns, ensure accurate payroll processing, and stay aligned with labor laws. Make the most of your time management with Everhour and keep your business running smoothly and in compliance with California’s labor regulations.

This is where the best time tracking software comes in. Everhour is the top time tracker for SMB teams. If you are managing a team of 5 or more and looking to boost efficiency, Everhour is the perfect tool to keep your team on track. With seamless time tracking, you can easily estimate task durations, set clear budgets, and generate detailed reports inside Asana, Trello, Jira, or any other pm tool.