A statutory employee occupies a unique classification in the U.S. workforce, falling somewhere between a traditional employee and an independent contractor. While they operate with some degree of independence, statutory employees are subject to specific rules for tax purposes that differentiate them from fully independent contractors. Understanding the criteria and tax obligations for statutory employees is crucial for both businesses and workers to ensure compliance with IRS guidelines and avoid misclassification risks. In this article, we’ll explore the key characteristics of statutory employees, tax considerations, and the benefits and potential drawbacks for both workers and employers.

Statutory Employee Definition

The meaning of a statutory employee is a worker who, while having some characteristics of an independent contractor, is treated as an employee for tax purposes under specific IRS guidelines. The key difference lies in the nature of tax withholdings: employers must withhold Social Security and Medicare taxes, but not federal income tax, from statutory employees’ earnings.

For a worker to qualify as a statutory employee, they must meet the following criteria:

1. Type of work: They perform services that are typically controlled by the company, even though they operate with some independence. The IRS designates four types of workers that can qualify:

- A driver distributing beverages (other than milk), meat, vegetables, fruits, or bakery products; or someone who picks up laundry or dry cleaning.

- A full-time life insurance sales agent primarily selling policies for one life insurance company.

- A home worker who works on materials or goods supplied by the employer and must return them to the employer or to someone the employer designates.

- A traveling or city salesperson working full-time for one firm or company, soliciting orders from businesses, wholesale or retail establishments, or organizations on behalf of the employer.

2. Control over work: The worker performs tasks under the direction of the company, though they maintain some independence in how the tasks are accomplished.

3. Consistent payments: They typically receive payments regularly and have deductions taken for Social Security and Medicare taxes.

These criteria ensure that statutory employees receive some employee benefits but also maintain a level of independence in how they manage their work. Understanding these qualifications is essential to ensure proper classification and compliance with tax laws.

Statutory Employee Examples

Examples of statutory employees

Delivery drivers

These employees deliver specific items such as beverages (other than milk), bakery goods, or laundry and dry cleaning services. For example, a driver employed by a bakery to deliver goods to retail stores and restaurants would be classified as a statutory employee if they meet certain conditions, such as working under the control of the employer regarding how deliveries should be made.

Insurance sales agents

Insurance agents selling life insurance primarily for one company fall under statutory employee status. This includes full-time agents who are not independent contractors and meet the IRS criteria for statutory employees. These agents, while receiving commissions, still work predominantly for a single employer and do not carry the independence typically seen in non-statutory roles.

Home workers

These are individuals who work from their own homes, assembling products or processing materials supplied by the employer. A home worker might, for instance, create handmade goods or garments using materials provided by the company, sending finished items back for distribution. Their work is controlled in terms of how and what they produce, making them statutory employees under the law.

Traveling salespeople

These individuals solicit orders from businesses or retailers on behalf of a company. For example, a traveling representative selling office supplies to various businesses would qualify as a statutory employee if they followed the employer’s guidelines regarding sales methods and products offered. They are distinct from independent contractors due to the level of control the employer has over their activities.

Rights and benefits of statutory employees

- Social Security and Medicare: Employers must withhold and contribute to Social Security and Medicare taxes for statutory employees, unlike independent contractors.

- No federal income tax withholding: Statutory employees are responsible for paying their own federal income taxes.

- Unemployment benefits: In most cases, statutory employees are eligible for unemployment benefits if they lose their job.

- Workers’ compensation: They may be eligible for workers’ compensation in case of a work-related injury, depending on state laws.

- Retirement plans: Depending on company policies, statutory employees may have access to retirement benefits like 401(k) plans.

While statutory employees maintain more independence than traditional employees, they are still entitled to certain benefits and protections that differentiate them from independent contractors.

Tips on Dealing with Statutory Employees

Understand classification criteria

Ensure you thoroughly

understand the IRS rules that distinguish statutory employees from independent contractors or regular employees.

Misclassification can lead to tax penalties and issues with benefits. Regularly review your employee classifications to stay compliant with the law.

Maintain proper tax withholdings

While federal income taxes aren’t withheld for statutory employees, you must still withhold and contribute to Social Security and Medicare taxes. Ensure you keep accurate records of payments and deductions to avoid potential tax complications.

Clarify job expectations

Since statutory employees fall somewhere between independent contractors and full-time employees, it’s essential to establish clear expectations regarding work duties, control over their work, and performance benchmarks. This helps prevent confusion about their role and responsibilities.

Offer appropriate benefits

While statutory employees don’t always receive the same benefits as regular employees, it’s crucial to understand which rights and protections they have, such as Social Security, Medicare, workers’ compensation, and possibly unemployment benefits. Make sure they’re aware of their benefits package.

Ensure accurate contract terms

Statutory employees should have clear contract terms specifying their working arrangements, payment methods, and obligations. This helps both the employer and employee stay aligned and avoid misunderstandings related to employment status.

Regular communication

Since statutory employees may not be on-site regularly, it’s important to keep open lines of communication regarding project expectations (via a statement of work), feedback, and company updates. Regular check-ins can ensure they remain engaged and aligned with business goals.

Avoid misclassification risks

Misclassifying a statutory employee can result in penalties from the IRS.

Be sure that your employment contracts, payment structures, and working conditions align with statutory employee requirements to avoid legal issues. Consult with legal or tax professionals when unsure about classification rules.

By following these tips, you can manage statutory employees effectively and ensure compliance with tax regulations while providing them with the appropriate benefits and support.

Tax Obligations for Statutory Employees

Statutory employees have unique tax obligations compared to regular employees and independent contractors. Here’s what employers and statutory employees should keep in mind:

- Social Security and Medicare taxes: We’ve already covered it but it’s worth repeating: employers must withhold Social Security and Medicare (FICA) taxes from the wages of statutory employees. These taxes are calculated at the same rates as for regular employees. The employer must also contribute their portion of these taxes.

- No federal income tax withholding: One significant difference for statutory employees is that federal income tax is not withheld from their wages. Employees are responsible for paying any federal income tax due when they file their tax returns.

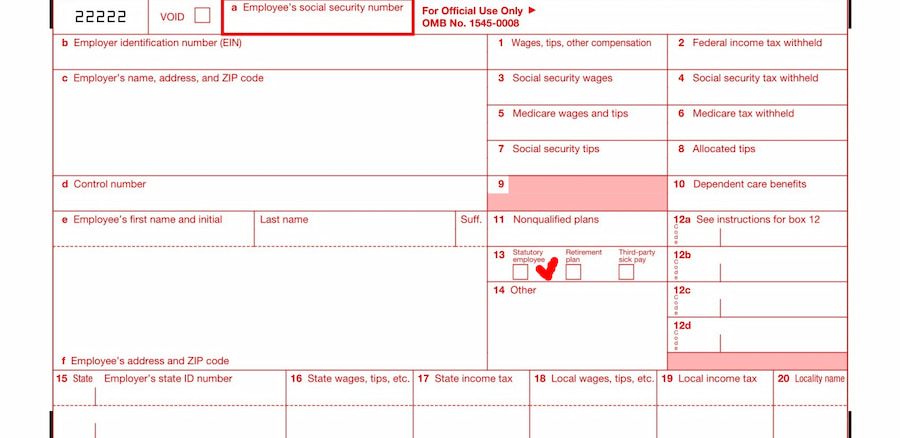

- Reporting wages: Employers must report statutory employee wages on Form W-2, indicating that the employee falls under this classification by checking the appropriate box in Box 13 (Statutory employee).

- Deductions on Schedule C: Unlike regular employees, statutory employees can deduct certain business expenses on Schedule C (Profit or Loss From Business) when filing their tax returns. This allows them to reduce their taxable income by claiming work-related expenses, such as equipment, travel, or office supplies.

- State tax variations: In some states, statutory employees may have different tax obligations. It’s important for both employers and employees to understand state-specific tax rules and withholdings to remain compliant.

Effortless Management of Statutory Employees Using Everhour

Dealing with statutory employees involves navigating a range of legal, tax, and operational challenges. From understanding employee status to ensuring proper tax filings, it’s essential to stay compliant while offering appropriate rights and benefits. Recognizing the distinct nature of statutory employees and applying the correct strategies will ensure smoother business operations and legal adherence.

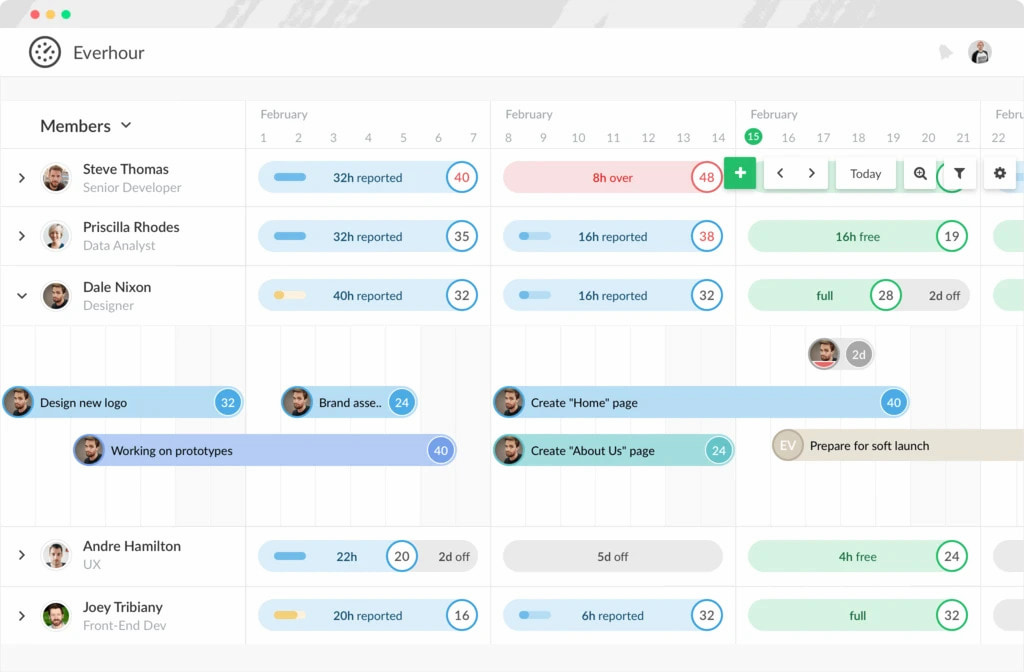

To simplify managing time tracking, expenses, and certified payroll for statutory employees, tools like Everhour can be invaluable. As one of the best expense trackers for businesses, Everhour offers features that assist in monitoring working hours and ensuring compliance with wage requirements. With its time tracking capabilities, employers can accurately record hours worked by employees, making it easier to comply with labor laws. This ensures that employers compensate workers fairly for their time, which is crucial for maintaining legal compliance.

Additionally, Everhour streamlines reporting processes, allowing businesses to track billable and non-billable hours effectively. This is particularly important for statutory employees who might have varied roles or responsibilities that affect their billing. By providing clear visibility into how employees spend their work time, Everhour helps managers make informed decisions about workload and resource allocation.

If you are managing a team of 5 or more and looking to boost efficiency, Everhour is the perfect time tracker to keep your team on track. Time tracking software can improve employee morale: you can easily estimate task durations, set clear budgets, and generate detailed reports inside Asana, Trello, Jira, or any other pm tool.

If taxes are too taxing (see what we did here?), check out our curated list of the best taxes and accounting memes to have a bit of a laugh!