Are you a business owner struggling to understand the complexities of tax obligations? As a savvy business owner, navigating the labyrinth of tax duties is part of the entrepreneurial journey. Among these is the fundamental step of securing a Federal Employer Identification Number, or FEIN. But what does FEIN mean in the broader context of running your business? Defining FEIN is not only about compliance—it’s about establishing your enterprise’s identity within the federal system. Let’s delve deeper into the world of FEIN meaning and why it matters for your business operations.

Understanding the FEIN: What It Is and How It’s Used

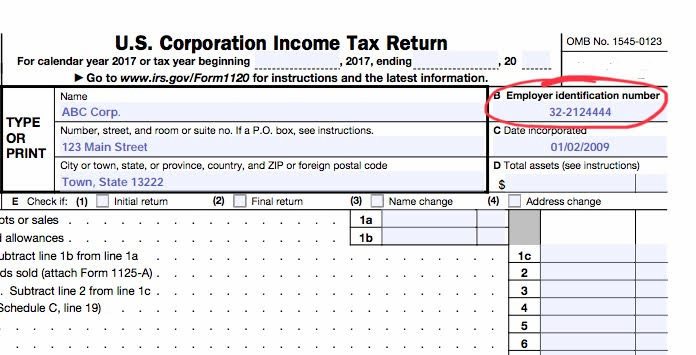

The definition of FEIN hinges on its role as a fundamental identifier for businesses. FEIN stands for Federal Employer Identification Number, operating as a nine-digit sequence the Internal Revenue Service assigns.

What does FEIN mean for a business? It means a singular identity within the U.S. federal tax system, separating it from personal tax identifiers. Upon the allocation of an FEIN by the IRS, it becomes the permanent tax ID number for the business unless modifications are made to the business entity or the account is closed. While most businesses utilize the FEIN as a taxpayer identification number (TIN), it is not mandatory for all businesses. Other examples of TINs include Social Security Numbers (SSNs) and Individual Taxpayer Identification Numbers (ITINs).

The EIN, a unique nine-digit identifier, holds the key to identifying businesses across the United States.

Structured in the XX-XXXXXXX format by the IRS, it’s not just a random series of digits; it’s a code that distinguishes and defines your business in the tax arena.

Understanding the FEIN definition isn’t just a matter of terminology; it’s understanding the essence of your business’s identity within the tax framework.

How Is the FEIN Used?

The FEIN is a unique identifier for your business, recognized by the IRS. It’s needed for various entities like:

- Sole proprietorships

- Partnerships

- Non-profits

- Trusts and estates

- Corporations

💼 For business taxes:

The FEIN is essential when filing tax documents (like Form W-2 and Form 941) and managing payroll.

If you have employees, you’ll need an FEIN to handle payroll taxes (Social Security, Medicare, etc.) and issue W-2 forms.

💳 For business finances:

You can use your FEIN to open business bank accounts, apply for business credit cards, and even get business loans. It’s like a Social Security number for your business!

💡 Key points:

- Required for hiring employees

- Not always needed for subcontractors

- Helps with tax filing, payroll, and establishing business credit

Who Needs a FEIN?

It’s important to know if you need a federal employer identification number (FEIN). You must have a FEIN if your business hires employees. The IRS also requires a FEIN if your business:

- Is organized as a corporation or partnership

- Files specific taxes like employment or excise taxes

- Withholds taxes on non-wage payments to non-resident aliens

- Operates a Keogh retirement plan

You may also need a FEIN if you are involved with:

- Trusts (except IRAs, certain revocable trusts, and exempt organization tax returns)

- Nonprofit organizations

- Estates

- Real estate mortgage investment conduits (REMICs)

- Agricultural cooperatives

- Plans where you act as the administrator

If you own multiple businesses, you must get a separate FEIN for each one.

How to Find Your FEIN?

🔍 Check past documents:

Look at previous tax returns — your FEIN is usually near the top of the first page. You can also check any IRS correspondence or confirmation letters.

🏢 Contact state agencies:

If you’ve registered for business licenses or permits, your FEIN might be listed in those state documents.

📞 Call the IRS:

If you can’t find it, contact the IRS Business & Specialty Tax Line at 1-800-829-4933.

Have this info ready to verify your identity:

- Business name

- Mailing address

- Other identifying details

🔒 Keep it safe:

Your FEIN is sensitive info — only share it when necessary and store it securely.

Benefits of a FEIN

🔐 Unique and permanent:

An EIN is a one-time identifier. Once assigned to a business, it stays with that business forever — even if it closes. The IRS never reuses it.

🚀 You need it to get started:

You must have an EIN before launching business activities. It’s required for things like:

- Hiring and paying employees

- Opening a business bank account or applying for credit

- Filing taxes and registering with state agencies

- Maintaining legal protections for your business

💼 Helps protect your identity:

Using an EIN keeps your personal data separate from business dealings, lowering the risk of identity theft.

👷 Important for contractors:

Independent contractors and subcontractors usually need an EIN too — it’s how the primary business reports payments to the IRS.

How to Apply for FEIN

Thankfully, securing this EIN is a straightforward process available through several channels. Here’s a rundown of how to go about it:

💻 Apply online

The easiest and fastest way to get an EIN is through the IRS online portal. You can access the form on the official IRS website. The system is available Monday through Friday, from 7:00 a.m. to 10:00 p.m. Eastern Time.

To use the online application, your business must be located in the United States or U.S. Territories. You’ll also need a valid taxpayer identification number (such as a Social Security Number).

The online EIN application is divided into five sections:

- Identification

- Authentication

- Address information

- Business details

- EIN confirmation

Keep in mind: the system does not let you save your work and return later. If you’re inactive for 15 minutes, your session will end and all information will be lost. Make sure you set aside enough uninterrupted time to finish the application in one go.

📧 Apply through mail

To submit a request for an employer identification number via postal service, you must complete and provide a signature on the SS-4 form, then dispatch it to the following location:

Internal Revenue Service

Attention: EIN Operation

Cincinnati, OH 45999

A notice confirming the issuance of your Federal Employer Identification Number (FEIN) will be forwarded to you by mail.

Remember, if you opt for the mail-in application method, initiate this process well in advance of the date by which you require the identification number, as reliance on the postal system can result in a prolonged waiting period.

📠 Apply by fax

If you can’t apply online or prefer not to, you can get an EIN by fax. First, complete Form SS-4 (Application for Employer Identification Number). You can fax your form at any time — the service is available 24 hours a day.

Before sending it, carefully review your Form SS-4 to make sure all questions are answered correctly. Mistakes or missing information can cause delays.

Use the correct fax number based on your location:

- (855) 641-6935: If your main office, agency, or residence is in one of the 50 states.

- (855) 215-1627: If you don’t have a legal residence, principal place of business, or main office or agency in any U.S. state.

📱 Apply by phone (only if outside the U.S.)

If you’re applying for an EIN from outside the United States, you must do it by phone. Call 267-941-1099 between 6:00 a.m. and 11:00 p.m. Eastern Standard Time, Monday through Friday. This line is only for international applicants — if you’re in the U.S., you should not use it.

When you call, the IRS will ask you the same questions listed on Form SS-4. You can also authorize someone else to call and apply for the EIN on your behalf. To do this, you need to fill out the Third Party Designee section of Form SS-4 and sign and date it.

How to Cancel FEIN?

Once the IRS has assigned an FEIN to your enterprise, it ensures that this identifier is exclusively yours; no other entity will be allocated the same FEIN. It is important to note that an FEIN cannot be deactivated; however, you do have the option to close your IRS business account. It’s important to understand that closing your account does not equate to erasing the FEIN from IRS records.

To initiate the closure of your IRS business account, you must provide the official name of your company, its FEIN, the business address, and a clear explanation for the dissolution of the account. If available, you should also attach a copy of the EIN Assignment Notice that you received from the IRS. Please forward these documents to the following address:

Internal Revenue Service

Cincinnati, OH 45999

Before the IRS processes the closure of your business account, you must ensure that you have submitted all tax returns. The obligation to file applies to your business if you have:

- Conducted any federal tax deposits or made payments to the federal government.

- Any business tax returns that are outstanding.

- Got a notice from the IRS notifying you that you must submit your business tax returns.

Under certain circumstances, such as a change in business ownership or restructuring, a new FEIN may be necessary.

❓ FAQ: All Your Questions Answered

❓ FEIN vs. Tax ID

A Federal Employer Identification Number (FEIN) is a type of tax ID. Here are some common tax IDs:

- FEIN (Federal Employer Identification Number)

- SSN (Social Security Number)

- ATIN (Adoption Taxpayer Identification Number)

- ITIN (Individual Taxpayer Identification Number)

- PTIN (Preparer Taxpayer Identification Number)

FEINs are used to identify businesses, unlike personal tax IDs.

❓ FEIN vs. SSN

🔑 A Social Security Number (SSN) is for personal identification, while a FEIN is for business identification. If you’re a sole proprietor, your SSN may act as your business ID. But if you have employees, you’ll need a FEIN for tax purposes.

❓ What info do I need to apply for a FEIN?

📝 When applying, you’ll need details like:

- Business name

- Trade name (DBA)

- Number of employees

- Business address

- Owner’s SSN

- Business start date

- Accounting year info

❓ How long does it take to get an EIN?

⏳ The processing time depends on how you apply:

- Online: Instant

- Fax: 4 business days (with a fax number)

- Mail: 4-5 weeks

If you’re late, you can write “Applied For” on your tax form.

❓ Is FEIN public?

🔒 FEINs are public information and must be shared with businesses for tax forms and credit references. But be careful! Just like an SSN, it’s best to keep your FEIN private to avoid fraud.

❓ How much does a FEIN cost?

💸 A FEIN is free! However, it takes time and effort to complete the paperwork, so be prepared for some back-and-forth with forms.

FEIN Meaning: Secure Your Business Identity

Congratulations on securing your EIN! This is a key milestone for your new business, marking its official status and helping you protect your business and employees from daily risks.

Now is the time to implement risk management strategies and consider using a reliable time tracker. These steps will boost efficiency, support employee well-being, and lay the groundwork for long-term success.

If taxes are too taxing (see what we did here?), check out our curated list of the best taxes and accounting memes to have a bit of a laugh!