B2B market research isn’t just for large enterprises anymore. Whether you’re a startup founder, a scaling agency, or a mature B2B software company, research-driven decisions help you build the right product, market it to the right audience, and close deals faster. In an age where customer expectations are shifting rapidly and competition is fierce, relying on gut instinct alone is no longer a viable strategy.

This edition walks you through exactly how to do B2B market research—from defining your ICP to analyzing competitor positioning—using tools, tips, and workflows that match the speed and complexity of today’s business environment.

🎯 Step 1: Define Your Goals and Hypotheses

Before starting any survey or interview, ask yourself:

- 🎯 What decision will this research support?

- ❓ What knowledge gaps must we fill?

- ✅ What assumptions should we test?

Common B2B research goals include:

- 👔 Understanding how CFOs evaluate tools

- 💡 Gauging interest in a new feature or variant

- 🚧 Identifying sales objections or blockers

- 🗣️ Discovering pain points and language for messaging

💡 Tip: Build a one-page research brief outlining your goal, audience, method, timeline, and how success will be measured.

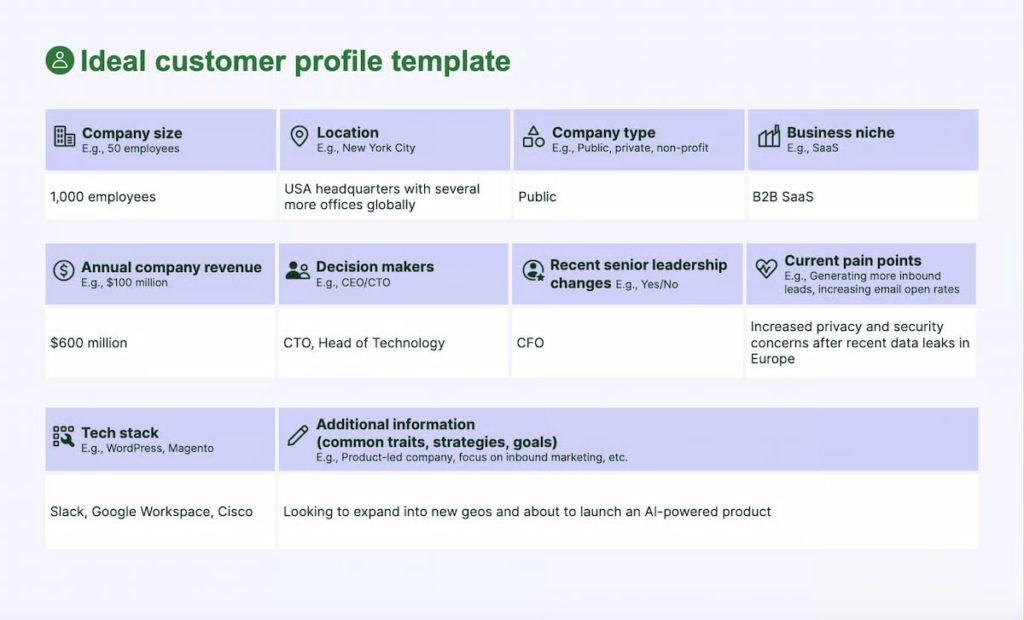

👥 Step 2: Build and Enrich Your Ideal Customer Profile (ICP)

A detailed ICP goes far beyond titles. To target effectively, map out:

- Company size and revenue

- Industry verticals and niches

- Technology stack (e.g., HubSpot, Slack, Notion)

- Buyer persona roles: decision-maker, champion, user, blocker

- Geographical markets and language preferences

- Known pain points, desired outcomes, and buying motivators

- Buying cycle length and ACV ranges

source: Pipedrive

Tools like Apollo.io, Clearbit, and LinkedIn Sales Navigator help enrich your ICP with real-time data.

📊 Step 3: Choose the Right Research Methods

To paint a full picture, combine qualitative, quantitative, and secondary sources.

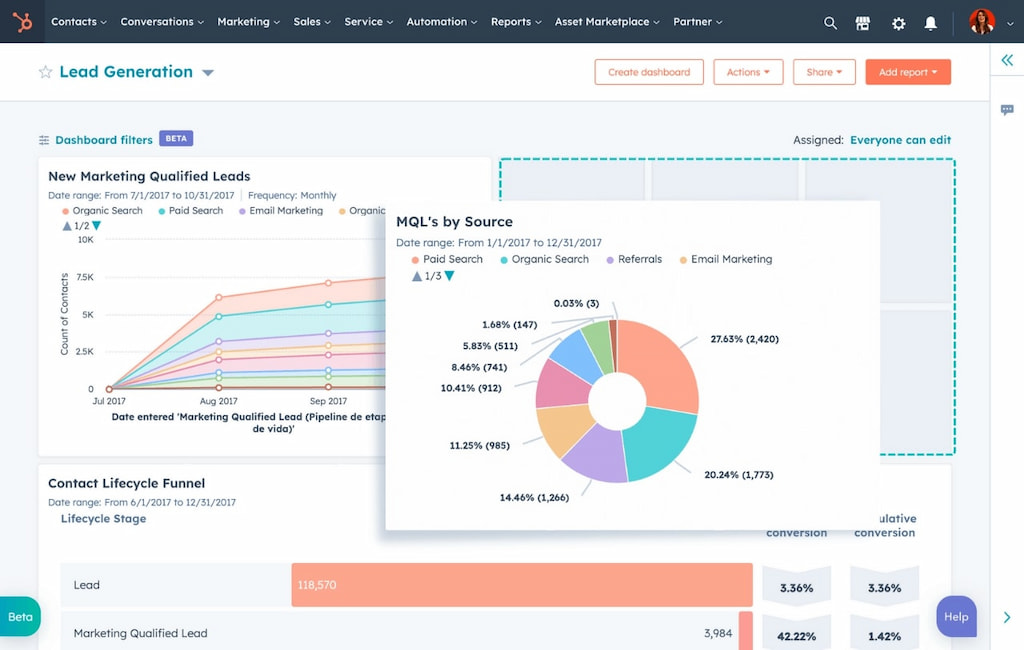

📊 Quantitative tactics

- Surveys via Google Forms, Typeform, or Survicate

- Website behavior tracking (Hotjar, GA4, Mixpanel)

- CRM and sales data (HubSpot, Salesforce reports)

💬 Qualitative tactics

- 1:1 interviews with current/prospective customers

- Slack group discussions, LinkedIn messages, community polling

- Recorded user tests using Maze, Lookback, or Useberry

📚 Secondary sources

- Analyst reports from Gartner, Forrester, McKinsey

- G2/Capterra reviews for direct user feedback

- Reddit and Quora threads about specific tools

💡 Tip: Use multiple methods to validate the same insight.

🧪 Step 4: Execute Primary Research Efficiently

Keep your process lean and lightweight:

- 👥 Aim to interview 5–10 qualified ICP matches

- ✅ Keep surveys concise (under 10 questions) and offer a reward

- 🎙️ Record calls and tag highlights using tools like Grain or Fireflies

🔧 Recommended tools

- 📅 Calendly + Zoom — for effortless scheduling and hosting

- 🔄 Zapier + Google Sheets — for automated form data collection

- ⏳ Everhour — Time tracker for internal research or billing

![track time like a pro with the best employee time tracking app [21 tools]](https://blog-cdn.everhour.com/blog/wp-content/uploads/2024/10/primary-screen-everhour.jpg)

🧠 Step 5: Analyze Findings for Strategic Insight

🔍 Identify patterns in your data

Once you’ve gathered enough raw data, focus on finding recurring themes:

- 🔁 Repeated complaints or unmet needs

- ✅ Common buying criteria and evaluation steps

- ❤️ Emotional cues — what excites or frustrates people?

- ⚡ Points of confusion, churn risks, or language gaps

🗂️ Organize insights by theme

Break down your findings into actionable categories:

- 💳 Purchase drivers and barriers

- 👥 Internal decision-making dynamics

- ⏳ Timing and urgency of need

- 📺 Preferred channels or content types

Finally, turn your findings into an insights summary or presentation deck aligned with your business objectives.

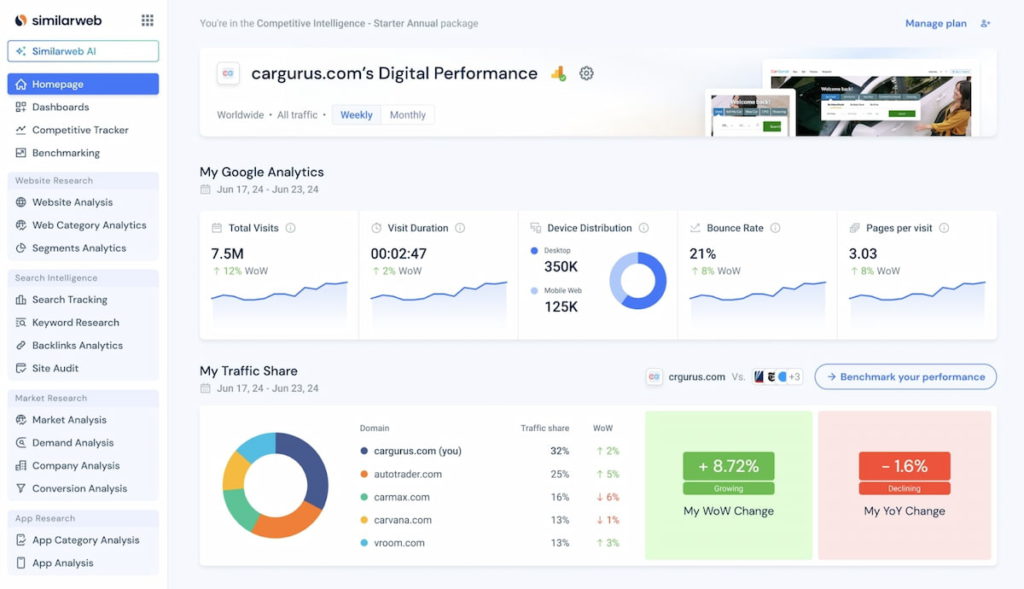

🔍 Step 6: Dive Into Competitor Research & Positioning

You can’t build your own positioning without knowing the current landscape. Do a deep audit of 3–5 competitors:

👀 What to analyze

- 🏁 Website: Headlines and core messaging

- ⚡ Features: Prioritized on landing pages

- 💳 Pricing: Tiers and conversion flows

- 🔍 SEO: Targeted keywords and blog strategy

- 📢 Marketing: Ad messaging, social proof, case studies

🛠️ Suggested tools

- 🌐 Similarweb — traffic insights

- 💻 BuiltWith — tech stack analysis

- 📊 Crayon or Kompyte — market intel and monitoring

💡 Goal: Map out gaps in the market or overused claims you can challenge and position against.

📌 Step 7: Turn Research Into Action

Don’t let your insights die in a Notion doc. Put them to work:

- ✍️ Rewrite value props and landing page copy using customer language

- 💬 Equip sales with talk tracks for common objections

- 🛠️ Prioritize product features that reduce key pain points

- 📈 Plan blog posts and content around search trends and customer questions

📋 Share a 1‑pager

Distill your work into a concise, actionable summary:

- 🔑 Top findings

- 💡 Buyer quotes

- ✅ Action recommendations across product, marketing, and sales

✅ Final Thoughts

B2B market research is now faster, cheaper, and more powerful than ever. Whether you’re refining your product roadmap, validating a rebrand, or scaling into a new vertical, these methods give you clarity without costly guesswork.

The winning formula? Combine qualitative depth with quantitative scale. It’s the best way to truly understand your audience and unlock growth.

🚀 Top B2B Research Tools

- Typeform, Survicate – Customer surveys

- Apollo.io, Clearbit – ICP enrichment

- GA4, Hotjar – Website behavior tracking

- Maze, Grain – User testing & interviews

- Everhour – Time and budget tracking for research ops

Need help turning insights into results? Our team helps B2B companies apply research to GTM, content, and product strategies that convert.

👍 Check out our other articles on B2B tools: